Research funding impact plays a pivotal role in shaping the future of innovation and entrepreneurship in the U.S. economy. The availability of financial resources, such as federal grants and venture capital, fuels the creative processes within research institutions, directly influencing the startup ecosystem. Numerous studies highlight that for every dollar invested in research, extraordinary returns can drive economic growth, driving both job creation and technological advancements. However, recent funding freezes threaten to disrupt this delicate balance, potentially stunting the growth of promising startups and limiting the flow of groundbreaking scientific discoveries into marketable solutions. Such setbacks not only hinder entrepreneurship but also pose a significant risk to the overall vitality of the U.S. economy, which relies heavily on innovative breakthroughs to maintain its competitive edge.

The implications of funding for scientific research are vast, impacting everything from technological advancements to the landscape of entrepreneurship. When discussing funding dynamics, terms like “innovation financing” and “research capital” often surface, emphasizing their crucial roles in economic development. The interconnection between resource allocation and the emergence of startups illustrates how vital these financial pathways are to fostering a vibrant entrepreneurial environment. Disruptions in funding mechanisms can hinder the transition from laboratory innovations to viable business solutions, ultimately affecting the broader economic health. As such, understanding the nuances of research funding illustrates the underlying foundations that support the entrepreneurial drive within the U.S.

The Importance of Research Funding in Innovation

Research funding is the lifeblood of innovation, especially in fields like science, technology, and medicine. Federal grants are crucial in supporting research initiatives that lead to groundbreaking discoveries. Without adequate funding, the capacity of institutions like Harvard to nurture new ideas diminishes, potentially stifling advancements that drive the U.S. economy. As investment in research wanes, the ability to foster entrepreneurship and develop the startup ecosystem suffers, reflecting a larger trend of economic stagnation.

The ongoing funding challenges faced by universities underscore the interconnectedness between research and economic growth. As cited in recent studies, every dollar invested in federal biomedical research results in approximately $2.56 in economic activity. This illustrates how robust funding mechanisms not only benefit academic institutions but also catalyze a vibrant entrepreneurship landscape that enhances the startup ecosystem, ultimately creating jobs and fostering innovation.

Impact of Research Funding Freeze on Startups

The freeze on research funding, particularly the more than $2 billion in grants affected at Harvard, poses a significant threat to the nation’s startup infrastructure. Startups often rely on cutting-edge research from universities to fuel their innovations. Without this crucial support, emerging companies may find themselves without the necessary data, technologies, or human capital to thrive. The ripples of this freeze could lead to a fewer number of promising entrepreneurs entering the market, which is concerning for an economy that thrives on innovation and creativity.

Moreover, the immediate repercussions of the funding freeze include hiring slowdowns and canceled initiatives, which, in turn, hinder the flow of innovative ideas from research labs to market. The longer this funding freeze persists, the more subdued the entrepreneurial pipeline will become. As Jeffrey J. Bussgang points out, the ideas currently in development may take years to mature into viable startups, meaning we might not feel the full effects of this freeze for years to come, highlighting a precarious situation for future innovation.

Catalysts for Economic Growth through Entrepreneurship

Entrepreneurship is often hailed as a key driver of economic growth in the U.S., and its success heavily relies on the foundation provided by research institutions. The innovative ideas that stem from academic research lay the groundwork for new startups, fueling job creation and technological advancement in various sectors. According to experts, well-resourced laboratories are more successful at generating commercially viable ideas, thereby contributing to a dynamic economy. As such, the symbiotic relationship between research funding and entrepreneurship becomes apparent.

Furthermore, as startups emerge from these innovative ideas, they invigorate local economies and create a ripple effect of growth across related industries. For instance, a biotech startup originating from university research can lead to new job opportunities in manufacturing, regulatory affairs, and marketing. This interconnectedness emphasizes the necessity for sustained funding in research to keep the entrepreneurial spirit alive, ultimately encouraging a more robust U.S. economy.

The Role of Federal Grants in Startup Ecosystem

Federal grants serve as a critical component in nurturing the startup ecosystem by providing necessary resources for research and development. These grants enable researchers to explore novel ideas and technologies that can lead to significant breakthroughs in various fields, especially in tech and biomedical sectors. As startups often emerge from academic research, limiting these grants can curtail innovation, stifle creativity, and reduce the pool of potential entrepreneurial talent ready to make their mark in the industry.

The intricate relationship between federal funding and the success of startups highlights the dependence of the entrepreneurial landscape on public investment in research. By supporting scientific endeavors through grants, the government not only furthers academic research but also catalyzes the formation of startups that drive economic progress. It’s imperative that policymakers recognize the significance of these grants and advocate for their expansion to sustain a vibrant economy fueled by innovation.

Long-Term Effects of Funding Cuts on Innovation

In the short term, funding cuts may appear manageable, but their long-term effects can be detrimental to innovation in the U.S. As noted by experts, the ripple effects from a funding freeze will likely take one to three years to fully emerge. During this time, the pipeline that nurtures startups will effectively dwindle, with fewer graduates and researchers able to transition into entrepreneurial roles. This gap can create a stagnant atmosphere within the entrepreneurial ecosystem, slowing down the rate of technological advancement.

Moreover, the knowledge lost during this hiatus in funding can be irreplaceable; potential breakthroughs may never manifest if the researchers behind them are unable to continue their work. Considering the detailed economic analysis that links research funding to economic vitality, the consequences of the cuts can extend beyond entrepreneurship and innovation, impacting the broader U.S. economy’s stability and growth potential.

Universities as Incubators for Entrepreneurs

Universities play a pivotal role as incubators for the next generation of entrepreneurs, combining education with rigorous research initiatives. Institutions like Harvard have established systems that support faculty and students in transitioning from academic research to real-world applications. The presence of technology offices, mentorship programs, and entrepreneurial courses creates an enriching environment for aspiring innovators. These initiatives help bridge the gap between theoretical knowledge and practical application, fostering an entrepreneurial mindset essential for startup success.

As students engage with faculty, they are exposed to real-world challenges and key business strategies, equipping them with the skills necessary to launch their ventures. This collaboration not only enhances the entrepreneurial learning experience but also spurs scientific innovation, resulting in the establishment of startups that contribute to economic growth. In advocating for sustained research funding, it becomes paramount to recognize and cultivate this incubative role of universities in shaping the future of entrepreneurship.

Challenges Facing Entrepreneurship Amidst Funding Cuts

The landscape of entrepreneurship faces numerous challenges, particularly in light of recent funding cuts affecting research institutions. Startups that depend on the crucial innovations developed within academic settings may struggle to find the resources they need for growth and development. As researchers are hindered by funding shortages, the flow of new ideas into the startup ecosystem diminishes, impeding the overall vibrancy that is essential for a thriving entrepreneurial environment.

Moreover, with fewer resources available, potential entrepreneurs may hesitate to pursue venture creation, fearing the lack of support and funding. The existing uncertainty created by fluctuating research funding can dissuade talented individuals from entering the entrepreneurial arena. Thus, the need for robust federal grant systems becomes increasingly urgent to prevent a downturn in innovation and ensure that the U.S. economy continues to benefit from a strong startup culture.

Federal Investment as a Pillar of Growth

Federal investment in research has historically been a pillar of growth for the U.S. economy, fostering innovation and enabling the emergence of numerous highly-successful startups. The substantial returns generated from public funding in research illustrate its critical importance; for instance, data reveals that every dollar invested in biomedical research generates significant economic activity. These returns are not just numbers but reflect real job creation and market growth, reinforcing the need for continued federal support.

The entrepreneurial ventures that thrive on such research investments have the potential to create lasting solutions to societal challenges, while also improving the overall competitiveness of the U.S. economy on a global scale. As innovation remains central to economic expansion, it is imperative to advocate for sustained and increased federal funding to nurture research initiatives that feed the startup ecosystem and drive comprehensive growth.

The Future of Entrepreneurship in an Evolving Landscape

As the landscape of entrepreneurship evolves, the interplay between research funding and startup success remains crucial. Emerging industries are heavily reliant on the progressive research conducted within academic institutions, enabling them to innovate and reinforce their market positions. While current funding freezes may cause temporary setbacks, the long-term vision for entrepreneurship must focus on revamping research funding policies to ensure a steady flow of innovative ideas into the marketplace.

The future of entrepreneurship will be shaped by how well we adapt to these funding challenges. By fostering a collaborative environment among government, research institutions, and the private sector, we can cultivate resilience and stimulate growth. It is essential to prioritize research funding not just as a necessary expenditure but as an investment in the future of innovation, entrepreneurship, and the economic prosperity of the nation.

Frequently Asked Questions

How does research funding impact the U.S. economy and innovation growth?

Research funding is crucial for the U.S. economy as it drives innovation, leading to the development of new technologies and companies. Studies indicate that every dollar invested in federal biomedical research generates approximately $2.56 in economic activity, highlighting its significant impact on economic growth and entrepreneurship.

What role do federal grants play in the startup ecosystem?

Federal grants provide essential funding for research and development initiatives that fuel the startup ecosystem. They enable academic institutions to foster innovation, allowing researchers and students to transform their ideas into viable startups that contribute to economic growth.

Why is federal funding critical for technology and biomedical startups?

Federal funding supports technology and biomedical startups by ensuring access to well-resourced research facilities and talent. This funding helps accelerate the development of groundbreaking ideas into commercially successful companies, propelling economic growth and fostering entrepreneurship.

What are the potential consequences of research funding cuts on entrepreneurship?

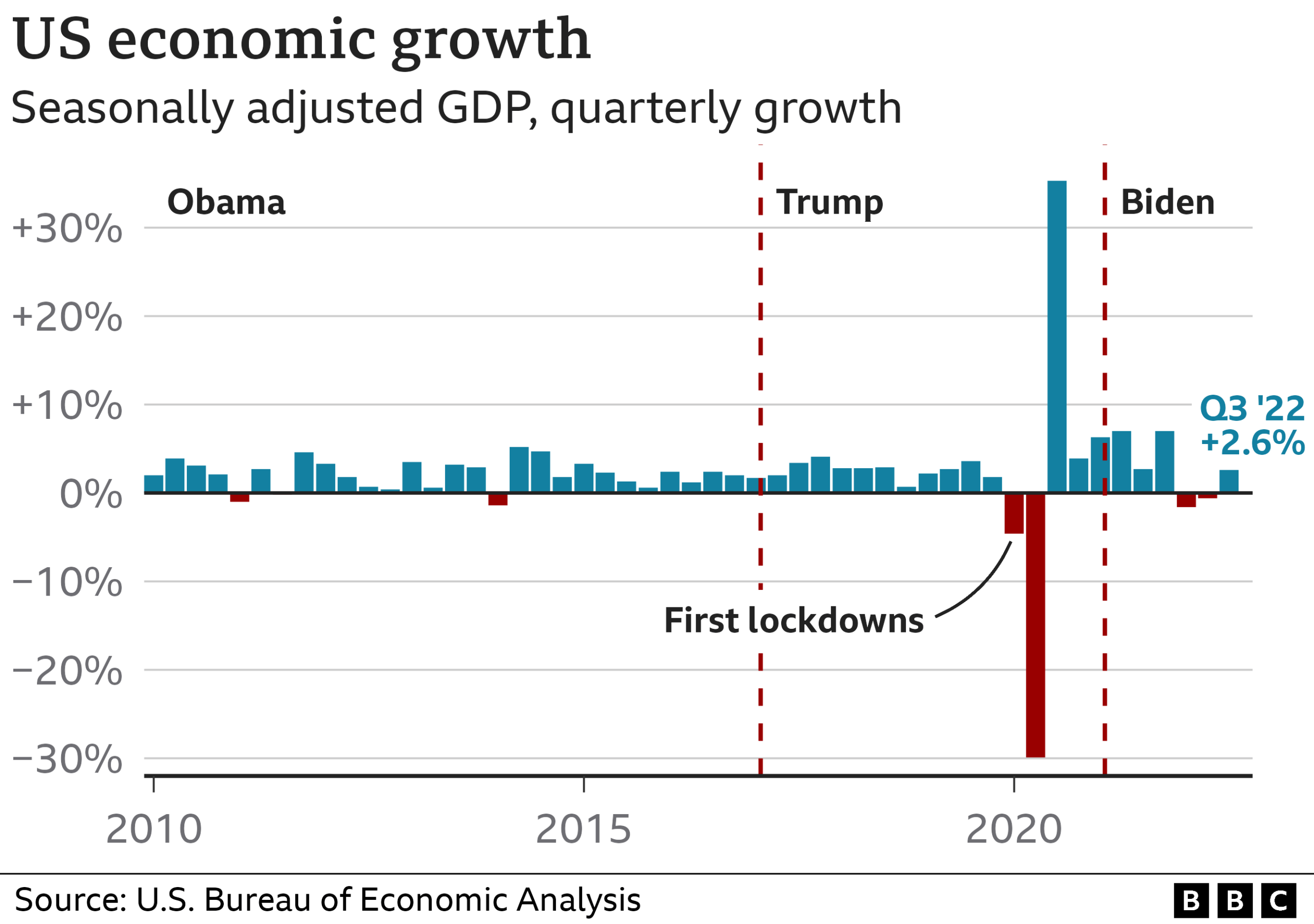

Cuts to research funding can severely impact entrepreneurship by stifling innovation and reducing the number of startups emerging from research universities. The resulting decline in new companies can have a ripple effect on the U.S. economy, mirroring downturns similar to past economic recessions.

How do research universities contribute to the innovation funding landscape?

Research universities act as incubators for innovation, bridging the gap between academics and startups. They offer resources, mentorship, and an entrepreneurial curriculum that enables students and faculty to capitalize on their research, ultimately driving innovation funding in the startup ecosystem.

What long-term effects can we expect from a freeze in federal research funding?

A freeze in federal research funding can lead to a decline in new startup formation over the medium to long term. The disruption in funding affects hiring, project initiation, and the overall innovation pipeline, resulting in fewer companies bringing new technologies to market in the coming years.

How does entrepreneurship education in universities affect research funding impact?

Entrepreneurship education equips students with the skills needed to launch successful startups, directly enhancing the impact of research funding. By teaching students how to commercialize research, universities increase the likelihood of innovation leading to economic growth.

What steps can be taken to mitigate the impacts of research funding cuts on the startup ecosystem?

To mitigate impacts from research funding cuts, stakeholders can advocate for restoration and increase of federal grants, support alternative funding sources, and strengthen partnerships between universities and venture capitalists, ensuring continued investment in innovation and startup development.

How do funding decisions influence the future of health-related startups?

Funding decisions directly influence the trajectory of health-related startups by determining the resources available for groundbreaking research. A decrease in funding can hinder the development of innovative solutions in healthcare, impacting overall public health and economic stability.

In what ways can innovation funding enhance the U.S. entrepreneurship landscape?

Innovation funding enhances the U.S. entrepreneurship landscape by providing start-ups with essential resources for research and development. It helps foster a culture of innovation where new ideas can flourish, ultimately translating into economic growth and job creation.

| Key Point | Details |

|---|---|

| Impact of Funding Cuts | Harvard’s funding cuts could shrink GDP by 3.8%, similar to the 2008 recession. |

| Federal Funding Importance | Essential for effective labs generating novel ideas and attracting talent. |

| Role of Universities | Research universities act as incubators for startups, supporting commercialization. |

| Effects of Grant Freezes | Hiring freezes and initiative cancellations slow the development of new companies. |

| Long-term Impacts | Negative effects on the startup ecosystem will take 1-3 years to fully manifest. |

Summary

Research funding impact is a critical aspect of U.S. economic growth, as evidenced by the significant consequences of federal funding cuts at institutions like Harvard. As the funding freeze disrupts research initiatives, the potential for innovation and entrepreneurial ventures diminishes, leading to adverse effects on the overall economy. If these trends continue, the U.S. risks not only losing its competitive edge in scientific advancement but also the vibrant startup ecosystem that drives economic recovery and progress.