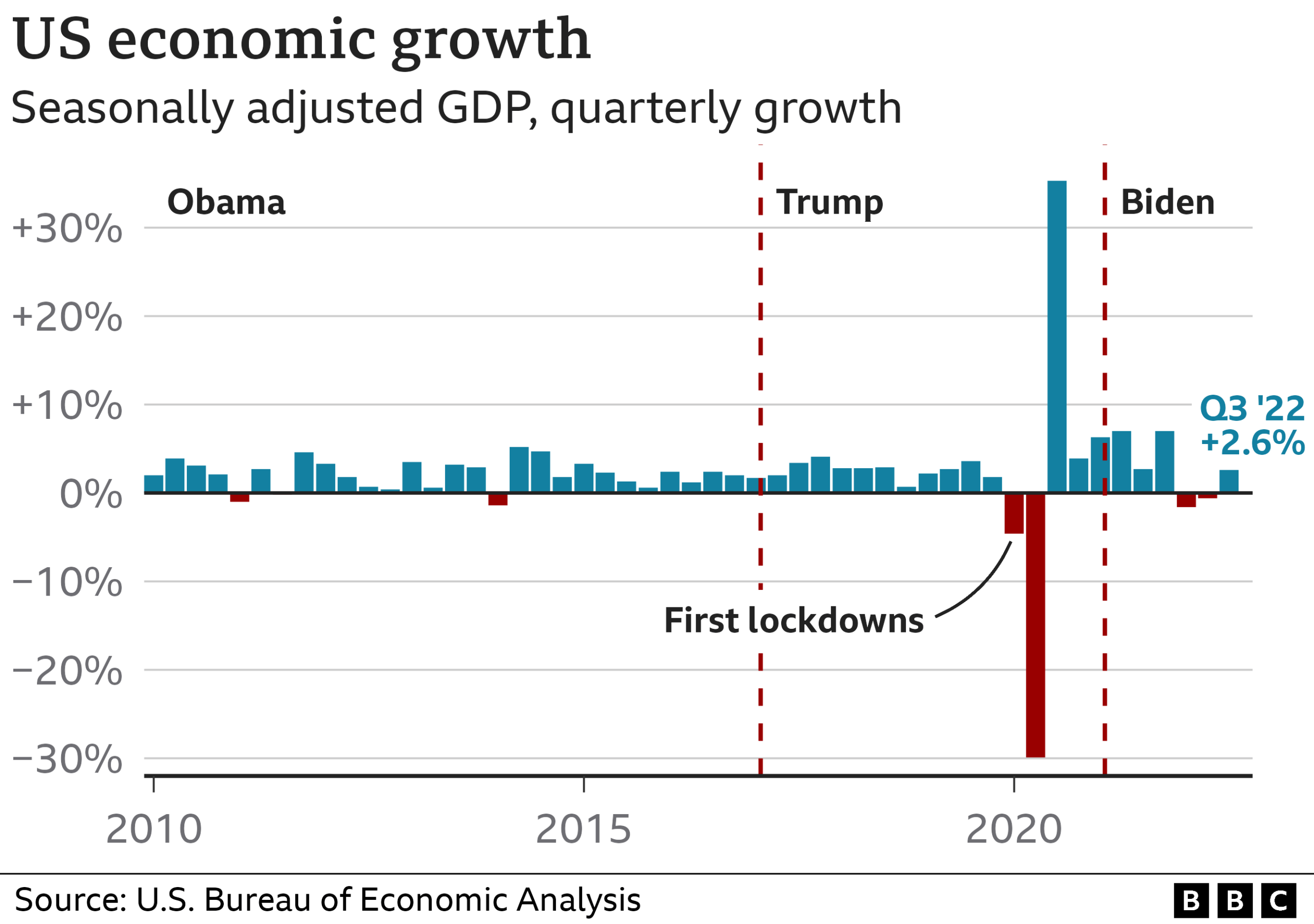

The U.S. economy is currently navigating turbulent waters, with a confluence of factors threatening its stability and growth. Recent warnings about a potential recession have arisen amidst escalating trade disputes, particularly with China, which cast a shadow over consumer sentiment and market performance. The Federal Reserve’s policies are under scrutiny as it considers how best to respond to rising interest rates and the implications for American businesses and households. As tensions from a trade war persist, many fear this volatile environment could lead the nation into an economic downturn. The pressures facing the U.S. economy demand careful observation and strategic maneuvers to avert the risks posed by these interrelated challenges.

The current fiscal landscape in the United States is fraught with challenges that evoke concerns over economic downturns and market fluctuations. With indications of a recession on the horizon, the interplay of tariffs and international trade relations has considerable repercussions for domestic consumers and investors alike. Analysts are closely monitoring how central banking decisions regarding interest rates may steer the economy away from potential pitfalls. The sentiment among consumers has shifted dramatically, reflecting broader anxieties about financial stability amid ongoing political dynamics. As the U.S. grapples with these significant economic factors, the path ahead remains uncertain yet critical for long-term prosperity.

Understanding the Current U.S. Economy

The U.S. economy is currently navigating through turbulent waters, exacerbated by a series of heightened international tensions and domestic policy changes. The recent trade war initiated by the U.S. administration has led to retaliatory tariffs from countries such as China, Mexico, and Canada. This escalation not only disrupts trade relationships but has significant implications for consumer sentiment, with many Americans feeling uncertain about the stability of their financial future. Such sentiments can directly affect spending habits, leading to a ripple effect throughout various sectors of the economy.

Additionally, market reactions to these policies have been dramatic, with stock prices plummeting and leading analysts to warn of a potential recession. The Federal Reserve’s role during such an unstable period is critical. Its policies on interest rates and inflation management will be under intense scrutiny as they balance the goal of economic recovery against the need to manage rising prices. The decisions made in these meetings could have a lasting impact on consumer confidence and overall economic health.

The Trade War Impact on the U.S. Economy

The impact of the ongoing trade war on the U.S. economy is profound, influencing everything from manufacturing output to consumer prices. As tariffs on imported goods increase, manufacturers face higher costs that are often passed down to consumers, resulting in inflated prices on everyday products. This scenario can stifle consumer sentiment, leading to reduced spending and slower economic growth. Economists warn that such policies could lead to a significant economic downturn if confidence continues to erode.

Moreover, the uncertainties associated with trade policies deter investments. Businesses operating under the fear of fluctuating tariffs may choose to withhold expansion efforts or capital investments, thereby jeopardizing job creation and overall economic momentum. The intertwining of trade policy and economic performance underscores the importance of navigating these turbulent waters with foresight and economic strategy.

Frequently Asked Questions

What impact do Federal Reserve policies have on the U.S. economy during a recession?

Federal Reserve policies are crucial in shaping the U.S. economy, especially during a recession. By adjusting interest rates, the Fed aims to stimulate economic growth by making borrowing cheaper, which encourages consumer spending and investment. However, if inflation pressures remain strong, the Fed may hesitate to lower rates, balancing the need for economic stimulus against the risk of exacerbating price rises. Thus, the effectiveness of Federal Reserve policies can significantly influence the severity and duration of a recession.

How does consumer sentiment influence the U.S. economy amid rising interest rates?

Consumer sentiment is a key indicator of the health of the U.S. economy, as it reflects how optimistic or pessimistic consumers feel about their financial situation. When consumer sentiment is low, individuals are less likely to spend money, which can slow economic growth. Rising interest rates can further dampen sentiment, as they increase borrowing costs for consumers and businesses. Therefore, a decline in consumer sentiment, combined with rising interest rates, can create a challenging environment for sustained economic expansion.

What are the potential effects of a trade war on the U.S. economy?

A trade war can have several adverse effects on the U.S. economy, including job losses in key sectors, increased prices for consumers due to tariffs, and disruptions in supply chains. As trade tensions escalate, businesses may face higher costs and reduced demand for their products, leading to a slowdown in economic growth. Moreover, if consumer sentiment declines as a result, the economy may be pushed closer to a recession, impacting overall GDP growth and employment rates.

Could the U.S. economy face a recession due to the Federal Reserve’s interest rate policies?

Yes, the U.S. economy could face a recession if the Federal Reserve’s interest rate policies are too restrictive in an attempt to control inflation. High interest rates can stifle investment and consumer spending, diminishing overall demand in the economy. If this occurs simultaneously with other negative economic indicators, such as low consumer sentiment or ongoing trade wars, the risk of recession heightens, as reduced spending can lead to job losses and further declines in economic activity.

What role does consumer sentiment play in predicting the likelihood of a U.S. recession?

Consumer sentiment is a vital predictor of the likelihood of a U.S. recession, as it reflects the confidence consumers have in the economy. When sentiment is high, consumer spending typically increases, stimulating economic growth. Conversely, low consumer sentiment can lead to decreased spending, which may signal a downturn. Economic indicators such as the University of Michigan’s consumer sentiment index help gauge this confidence and can predict shifts in the economy that may lead to recession.

How might a trade war influence interest rates in the U.S. economy?

A trade war can influence interest rates in the U.S. economy by increasing uncertainty and economic volatility. If a trade war leads to slower economic growth and rising inflation, the Federal Reserve may be forced to raise interest rates to counter inflationary pressures. Conversely, if consumer sentiment and economic activity decline significantly due to the trade war, the Fed might consider cutting interest rates to stimulate growth. This complex interplay demonstrates how trade tensions can directly affect monetary policy decisions.

| Key Issue | Details |

|---|---|

| Market Response to Tariffs | Heavy losses in U.S. markets due to tariffs imposed by China, Mexico, and Canada. |

| Investor Sentiment | Fear of recession prompted by ongoing trade war and declining consumer sentiment. |

| Federal Reserve’s Dilemma | Federal Reserve is considering interest rate cuts amidst economic pressures and uncertainty. |

| Trade War Impact | Potential recession risk exacerbated by trade wars, government spending cuts, and stock market volatility. |

| Long-Term Consequences | Uncertainty could persist, negatively impacting employment and economic growth. |

Summary

The U.S. economy is currently navigating through trying times marked by trade tensions and declining consumer sentiment. With the looming risk of a recession, driven by trade wars and market volatility, understanding these dynamics is critical. The Federal Reserve faces a challenging decision as it balances interest rates in response to potential economic slowdowns. Overall, the ongoing instability underscores the interconnectedness of trade policies and economic health in the U.S. and highlights the need for careful policy adjustments to foster growth.