When it comes to understanding finance and improving financial literacy, the best books on money provide invaluable insights that transcend mere principles. Whether you are looking to manage personal finances or navigate the complexities of the global economy, exploring money management books can illuminate the path to financial wisdom. Notably, economics books delve into the theories and practices that shape our understanding of money, while books about money often blend storytelling with practical advice. For anyone eager to advance their knowledge, these financial literacy books emphasize the significance of informed decisions in both personal and professional settings. In this digital age, where financial topics dominate discussions, uncovering the best reads can significantly enhance one’s grasp of monetary matters and economic concepts.

In an era where financial knowledge is paramount, exploring top-rated literature on personal finance and economic principles is essential. These influential resources not only offer strategies for effective money management but also provide compelling narratives that enrich our comprehension of economic behaviors. From historical accounts that illustrate the evolution of monetary systems to contemporary analysis regarding fiscal responsibility, these texts are invaluable for anyone aiming to enhance their understanding of finance. Books centered on economic theories further introduce readers to fundamental concepts that impact our daily lives, making them crucial for anyone vested in financial wellness. Thus, the landscape of literature surrounding the economics of money is both extensive and enlightening, providing diverse insights that are beneficial for all.

Top Recommended Books on Money Management

If you’re looking to enhance your financial literacy, there are countless resources available, but some stand out above the rest. The best books on money management not only equip readers with essential skills but also offer transformative perspectives on personal finance. Books such as “Money” by Jacob Goldstein provide an engaging history of currency, making it easier to understand the complexities of economic systems. This narrative style keeps the reader invested while explaining fundamental concepts, making it an ideal starting point for anyone interested in money management.

Additionally, for readers seeking deeper insights into financial systems, “The Future of Money” by Eswar S. Prasad offers a thorough examination of emerging trends like cryptocurrencies and digital currencies. This book presents a balanced view on the transformative power of technology in finance, allowing readers to navigate both opportunities and risks effectively. Incorporating the wisdom found in these money management books can lead to better decision-making and a clearer understanding of economic principles.

Exploring Essential Economics Books

Understanding the fundamentals of economics is crucial for anyone aiming to grasp the intricacies of financial systems. Economics books such as “The Ascent of Money” by Niall Ferguson delve into the historical evolution of finance, connecting past practices to modern-day economic issues. This book not only educates but also entertains, offering insights into how historical financial systems shape current economic policies and institutions.

Furthermore, Kenneth S. Rogoff’s “The Curse of Cash” breaks down the implications of currency evolution, discussing how the transition to digital currency might impact our economy. Each of these economics books emphasizes the importance of understanding monetary policy and historical context in facilitating informed financial decisions today. By broadening your knowledge through these well-regarded texts, you can better navigate the challenges of modern finance.

Books to Enhance Financial Literacy

Financial literacy is essential for making informed economic choices, and several standout books can help anyone improve in this area. “Ben Franklin: An American Life” by Walter Isaacson reveals how Franklin’s innovative approaches to money, such as paper currency, had lasting influences on our financial systems. By examining Franklin’s contributions, readers gain insight into the historical foundations of modern finance, which is vital for building financial literacy.

In addition, Claudia Goldin’s “Career and Family” explores the intersection of economics with societal issues, specifically the balance between professional aspirations and personal life for women. This book highlights real-world financial implications of family dynamics, thereby enhancing one’s understanding of economic participation. By engaging with these insightful books about money, readers can develop a solid foundation of financial literacy that is applicable in both personal and professional realms.

Insights from Harvard Economists: Books on Money

Several preeminent Harvard economists have recommended a selection of books on money that provide valuable insights into economic policies and theories. For instance, “Money Mischief” by Milton Friedman delves into monetarism, exploring how money supply impacts different economic variables. This book is fundamental for anyone looking to understand the underlying principles of money management and economic theory.

Moreover, the recommendation of “The Price of Peace” by Zachary D. Carter is particularly notable as it intertwines biographical elements of John Maynard Keynes with a discussion of monetary policy. This combination offers readers unique perspectives on how economic theories are developed and applied, making these books on economics indispensable for anyone wanting to grasp the complexities of monetary interactions.

Understanding the Impact of Central Banking through Recommended Reads

Central banking plays a crucial role in shaping economic environments, and exploring this topic through the lens of recommended books can enhance your understanding significantly. “The Only Game in Town” by Mohamed A. El-Erian provides an in-depth analysis of central banks’ maneuvering during economic crises, shedding light on the intricacies of monetary and fiscal policies. This insight is valuable for grasping how central banks impact individual financial decisions.

Additionally, books like “The Future of Money” offer context on how central banks are adapting to innovations like digital currencies, illustrating the need for updated knowledge in the rapidly evolving financial landscape. These insights are critical for anyone looking to effectively engage with current economic discussions and financial strategies.

Classic Literature on Money and Economics

Classic literature, such as “The Forgotten Financiers of the Louisiana Purchase” by Larry Neal, provides a fascinating look into historical financial maneuvers and their present-day implications. This book reveals the financial intricacies behind significant historical events, highlighting the importance of money in diplomatic efforts, thereby enriching our understanding of economic history.

Building on this foundation, works like “The Curse of Cash” by Kenneth S. Rogoff deepen this historical context by discussing how cash and currency have evolved. These classic literature pieces not only enhance historical comprehension but also provide timeless insights applicable to modern economic conditions, emphasizing the lasting influence of financial practices.

The Role of Personal Finance Books in Economic Understanding

Personal finance books serve as vital tools for anyone wishing to enhance their understanding of economic principles. They often provide practical guidance on budgeting, saving, and investing, which are essential skills for achieving financial stability. Books on personal finance, like those recommended by Harvard economists, empower readers with actionable strategies to manage their money more effectively.

For example, resources that combine personal stories with economic lessons, such as those by renowned authors, can illustrate real-life applications of key economic concepts. This narrative approach not only makes learning about personal finance engaging but also ensures that readers can apply theoretical ideas to their everyday financial decisions.

Books that Offer Historical Perspectives on Money

Exploring historical perspectives on money allows readers to understand how past financial systems have shaped contemporary economic realities. Niall Ferguson’s “The Ascent of Money” weaves a narrative that explores the historical evolution of finance and banking through various cultures. This comprehensive approach provides readers with a critical context that informs current financial practices.

Similarly, “The Price of Peace” delves into the economic theories of John Maynard Keynes, illustrating how these ideas have influenced modern economics. By engaging with such historical texts, readers gain insight into the dynamics at play in today’s financial systems and are better equipped to make educated decisions.

The Connection Between Economics and Financial Policies

Understanding the connection between economics and financial policies is crucial for anyone looking to navigate the complexities of money management. Books such as “The Curse of Cash” by Kenneth S. Rogoff highlight the changing landscape of currency and its implications for economic policies. This understanding is vital for recognizing how government actions influence individual financial situations.

Additionally, “Career and Family” by Claudia Goldin explores the economic factors that affect workforce participation, shedding light on policies that shape economic opportunities for different demographics. By studying these connections, readers can better comprehend the impact of economic decisions on personal finance, reinforcing the necessity of informed financial literacy.

Frequently Asked Questions

What are some of the best books on money management for beginners?

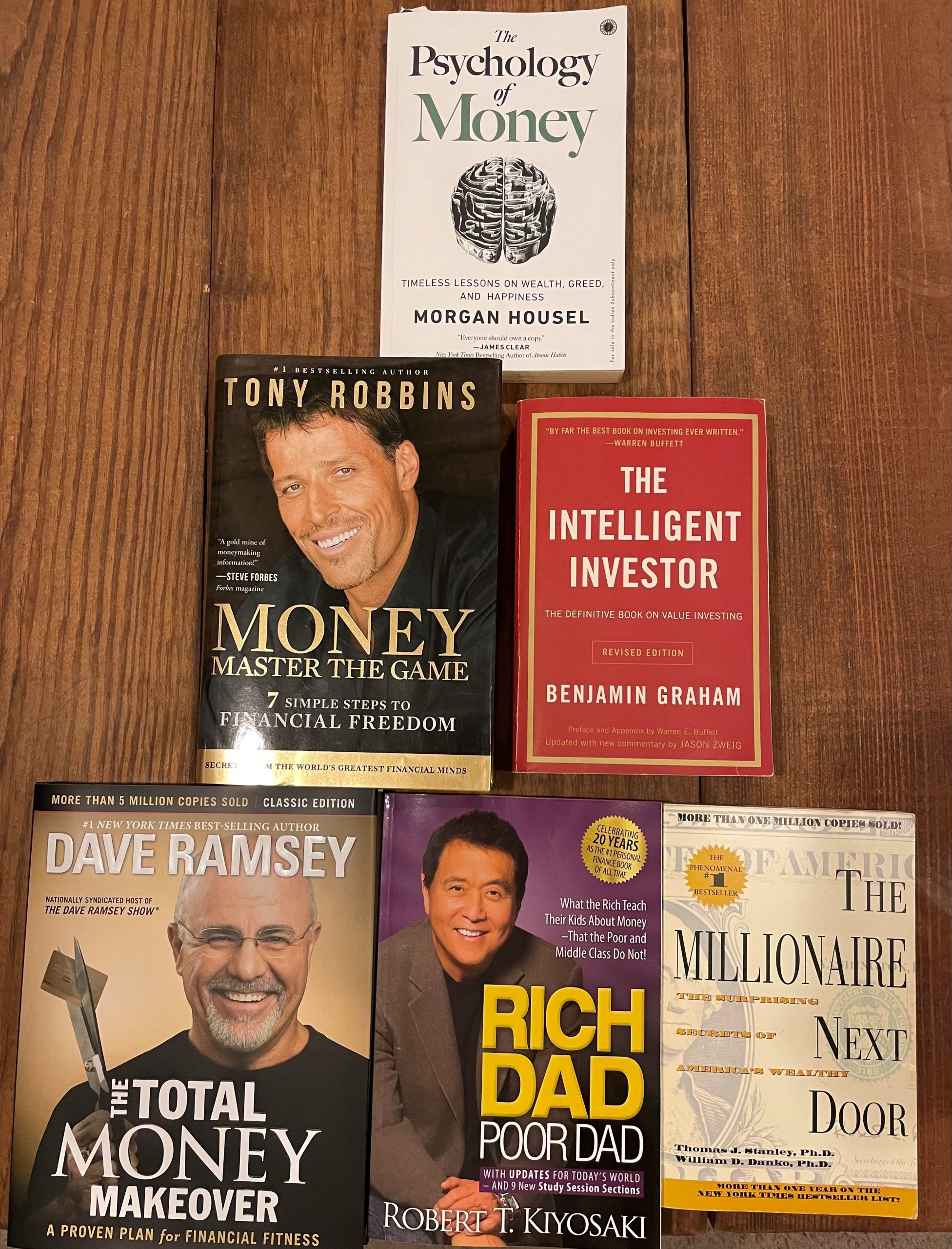

For beginners looking to improve their financial literacy, ‘The Total Money Makeover’ by Dave Ramsey and ‘Rich Dad Poor Dad’ by Robert Kiyosaki are among the best books on money management. These books provide foundational concepts, practical advice, and motivational insights to help readers develop a solid understanding of personal finance.

Which economics books are considered essential reading for understanding money?

Essential economics books that delve into money include ‘The Ascent of Money’ by Niall Ferguson and ‘Money Mischief’ by Milton Friedman. These texts explore the historical context of money, its evolution, and the underlying economic principles that govern financial systems, making them invaluable for anyone interested in economics.

What are the top financial literacy books recommended by experts?

Experts frequently recommend ‘The Millionaire Next Door’ by Thomas J. Stanley and William D. Danko and ‘Your Money or Your Life’ by Vicki Robin and Joe Dominguez as top financial literacy books. These works provide insights into effective money management habits and the psychology behind financial success, empowering readers with the knowledge to make informed financial decisions.

Can you suggest some engaging books about money that also entertain?

Engaging books about money that are entertaining include ‘Money’ by Jacob Goldstein and ‘The Only Game in Town’ by Mohamed A. El-Erian. Both authors present complex topics in an accessible and enjoyable manner, making them perfect for readers who want to grasp financial concepts without getting bogged down in technical jargon.

What are some highly regarded books on economics that focus on money-related topics?

Highly regarded books on economics that explore money-related topics include ‘The Future of Money’ by Eswar S. Prasad and ‘The Curse of Cash’ by Kenneth S. Rogoff. These books analyze modern monetary systems and the implications of digital currencies, providing an in-depth understanding of contemporary economic challenges.

Which books on money have received acclaim from economists?

Acclaimed books on money recommended by economists include ‘The Price of Peace’ by Zachary D. Carter and ‘Career and Family’ by Claudia Goldin. These books not only cover monetary policies and their effects on the economy but also highlight the broader social and historical context involved in financial decisions.

Are there any must-read money management books for anyone looking to invest?

Absolutely! Must-read money management books for aspiring investors include ‘The Intelligent Investor’ by Benjamin Graham and ‘A Random Walk Down Wall Street’ by Burton Malkiel. These books provide timeless investment strategies and insights that are essential for making informed investment decisions.

What are the most influential historical economics books regarding money?

Influential historical economics books regarding money include ‘The Wealth of Nations’ by Adam Smith and ‘An Inquiry into the Nature and Causes of the Wealth of Nations’ by Karl Marx. These seminal works analyze how systems of money and finance shape economies and influence societal structures over time.

| Book Title | Author | Key Insight |

|---|---|---|

| Money | Jacob Goldstein | An entertaining history of money and its concepts. |

| The Future of Money | Eswar S. Prasad | Balanced view on cryptocurrencies and central bank digital currencies. |

| Money Mischief | Milton Friedman | Engaging analysis of monetarism post World War II. |

| The Price of Peace | Zachary D. Carter | Biography of Keynes and economic policies afterwards. |

| The Ascent of Money | Niall Ferguson | Detailed history of debt and finance across cultures and epochs. |

| The Only Game in Town | Mohamed A. El-Erian | Explores central banking’s expanded role post-financial crisis. |

| Ben Franklin: An American Life | Walter Isaacson | Overview of Franklin’s influence on currency and society. |

| The Curse of Cash | Kenneth S. Rogoff | History and future of currency and digital payments. |

| The Forgotten Financiers of the Louisiana Purchase | Larry Neal | Uncovers the financial backing of the Louisiana Purchase. |

| Career and Family | Claudia Goldin | Examines women’s roles in balancing careers and family. |

Summary

The best books on money provide readers with valuable insights into economics, finance, and history. The recommendations from leading Harvard economists cover a variety of themes—from the historical evolution of money and finance to the contemporary implications of digital currencies and central banking. These chosen works highlight not only the intricacies of monetary systems but also the cultural and societal impacts of financial decisions. For anyone looking to deepen their understanding of money, these books are a worthy investment.