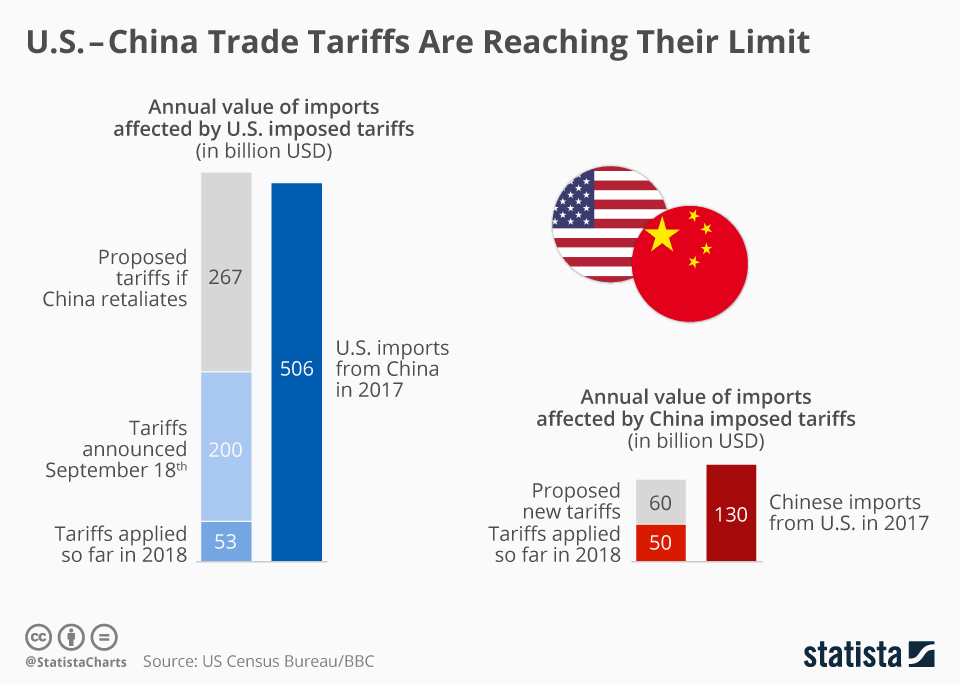

China tariffs have become a pivotal topic in discussions about U.S.-China relations and the dynamics of global trade. With the recent political climate emphasizing the imposition of such tariffs, economists warn of potential repercussions that extend beyond the borders of either nation. The ongoing trade war implications suggest that increased tariffs could not only elevate prices for American consumers but also culminate in significant supply chain disruptions across various industries. Furthermore, the impact of these tariffs on the economy could resonate through to consumer behavior and labor markets, all while complicating diplomatic ties with U.S. allies. As the scenario unfolds, China’s trade strategy remains firmly in focus, prompting a reevaluation of economic policies on both sides.

The financial landscape is being reshaped by policy decisions surrounding trade duties on goods imported from China. These tariffs, intended to curb foreign competition, may inadvertently lead to a cascade of unfavorable economic consequences for the U.S. While the application of protective tariffs aims to bolster domestic markets, it can also ignite friction in international trade relations and provoke retaliatory measures from trading partners. As the United States grapples with the implications of these strict tariffs, it is crucial to consider their ripple effects on global supply chains and the broader economy, which are increasingly interconnected. Navigating this complex web of tariffs and trade agreements is essential for fostering a stable economic environment amid escalating geopolitical tensions.

The Economic Backlash of China Tariffs on U.S. Consumers

Imposing tariffs on Chinese imports could lead to significant economic repercussions for American consumers. When tariffs increase, prices on imported goods typically rise, which directly affects the cost of living. Everyday items such as electronics, clothing, and household goods are likely to see inflated prices. This inflation hits lower and middle-income families the hardest, who spend a larger portion of their income on essential goods affected by the tariffs. Economists worry that consumers will face a tough choice: either pay higher prices or forgo products they depend on, potentially leading to a decrease in overall consumption.

Moreover, as costs rise due to these tariffs, consumers might shift their spending habits, impacting local businesses that also rely on affordable imported goods. The ripple effect could hurt the economy further, causing slowdowns in various sectors reliant on consumer spending. Thus, while the intention may be to pressure China, the longer-term effects of tariffs can lead to a weaken U.S. economy, diminished consumer purchasing power, and a strained relationship with allies that could complicate global trade further.

Supply Chain Disruptions Caused by Trade Policies

The implementation of new tariffs can lead to significant supply chain disruptions, a consequence that often goes overlooked in discussions regarding trade policies. Companies that rely on components manufactured in China may face higher production costs, which can delay product releases and affect inventory levels across the supply chain. This disruption not only impacts larger multinational corporations but also small-to-medium enterprises that might not have the capital or flexibility to absorb these costs or pivot to other suppliers.

Additionally, companies might need to find alternative sources for their materials, forcing them to explore markets that may not yet have the capacity or quality to match that of Chinese suppliers. This sudden shift could result in a decrease in quality, an increase in production lead times, and ultimately, a strained market environment where firms struggle to keep up with demand. All these factors contribute to an overall decline in efficiency and competitiveness in the U.S. market, which could exacerbate the economic issues tied to heightened China tariffs.

U.S.-China Relations Amidst Tariff Threats

Renewed tariff threats significantly alter the landscape of U.S.-China relations, which have already been strained over various geopolitical issues. Tariffs can be seen as not just economic tools but also as political weapons that could draw sharper lines in the global arena. As the U.S. takes a more aggressive stance on trade, analysts warn that it may prompt China to respond by solidifying relationships with traditional U.S. allies or pursuing new partnerships with nations such as Russia or members of the EU, creating a more polarized global economy.

This dynamic is particularly concerning for American foreign policy, which often relies on strong alliances. If China successfully fosters closer ties with U.S. allies by presenting a united front against American tariffs, it could redefine global power structures and influence trade negotiations going forward. A trade war could lead to further disconnects in U.S.-China relations, wherein both nations miss opportunities for collaboration on vital global issues like climate change and cybersecurity.

The Trade War Implications for Global Markets

The implications of a trade war extend far beyond the borders of the U.S. and China; global markets are also heavily influenced by this ongoing tension. As tariffs are imposed, countries that rely on trade with both nations may be forced to pick sides, which could alter historical trading patterns and economic alliances. Other emerging markets may see this as an opportunity to fill the gaps left by Chinese goods, but the transition isn’t simple, as many countries lack the infrastructure or capabilities to meet U.S. demand.

Furthermore, ongoing trade tensions often result in volatility in global stock markets, affecting investment flows and economic stability worldwide. Investors tend to favor certainty, and the unpredictable nature of trade policies can lead to hesitancy and reduced capital investment. As such, a protracted trade war could see a global economic slowdown, with reverberations felt by both emerging economies and established markets alike.

China’s Trade Strategy and Response to Tariffs

China’s approach to navigating tariffs and trade policies is multifaceted, reflecting a long-term strategy aimed at minimizing economic disruptions while maintaining its global standing. The nation has increasingly focused on diversifying its trading partners and seeking to expand trade agreements with countries outside the traditional Western sphere, potentially lessening its dependence on U.S. markets. Efforts such as the Belt and Road Initiative demonstrate China’s commitment to building economic ties through infrastructure development in countries throughout Asia, Africa, and beyond.

Moreover, China’s strategy also involves improving domestic consumption and self-sufficiency in key industries. Initiatives geared towards technological advancements and reducing reliance on foreign components could provide a counterbalance to potential losses from U.S. tariffs. By boosting innovation and fostering homegrown industries, China aims to create a more resilient economy that can withstand external pressures and safeguard its market share against fluctuations in U.S. trade policies.

Impacts of Labor Shortages Due to Tariffs

Labor shortages are another unintended consequence of imposing tariffs on imports from China. When tariffs raise production costs, companies may be forced to scale back operations or even offshore jobs as they seek to maintain profitability amidst increased expenses. This could exacerbate existing labor shortages in critical industries, particularly in manufacturing sectors that are already struggling to find skilled workers.

As industries face higher operational costs, they may also cut back on expansion efforts, which ultimately inhibits job creation domestically. The ripple effect on the labor market can further strain the economy, limiting opportunities for workers and compounding issues related to wage stagnation. In the long run, failing to address these labor constraints could lead to a less competitive manufacturing sector, increasing the U.S.’s reliance on foreign products, particularly if domestic production becomes too costly.

The Currency War Threat Between U.S. and China

The threat of currency wars becomes more prominent in the context of escalating tariffs between the U.S. and China. As trade tensions rise, nations may resort to manipulating their currency values to gain competitive advantages in global trade. If the U.S. enacts aggressive tariffs, it could lead to intentional devaluation of the Chinese yuan as a retaliation tactic, aiming to make Chinese exports cheaper and more competitive on the international market.

This competitive devaluation poses risks not only to bilateral relations but also to the stability of worldwide financial markets. Currency fluctuations can impact trade balances, investment flows, and ultimately economic growth, leading to a fall in confidence among global investors. Consequently, a currency war initiated in response to tariffs can create a vicious cycle further deteriorating economic relations and complicating international trade landscapes.

Nations Poised to Fill the Gap Left by China

As the U.S. considers imposing stringent tariffs, nations such as Vietnam, India, and Mexico are strategically positioned to potentially fill the gaps left by a decline in Chinese imports. These countries may leverage the opportunity to enhance their manufacturing capabilities and attract investment, particularly if U.S. companies seek alternative low-cost production sites. However, translating potential into actual economic gain will depend heavily on each country’s ability to rapidly scale their production and improve the quality of their goods.

For instance, while Vietnam has shown promise, its proximity to China could mean that any supply chain disruption in China will also affect the Vietnamese economy. Additionally, India’s known capacity for growth in technology and manufacturing sectors could take years to fully develop the infrastructure needed to meet U.S. demand. Consequently, while there are nations ready to step in, whether they can successfully do so depends on numerous factors, including capacity building and investment attraction.

Strategic Alliances in the Wake of Tariff Imposition

The potential for U.S. tariffs to foster strategic alliances among nations targeted by these trade policies is significant. Countries like Brazil, Australia, and Canada may find common ground in their opposition to U.S. tariffs, leading to collaborative efforts aimed at offsetting economic hits. This dynamic could shift international trade relations, with nations uniting to propose alternative trading agreements, thereby creating new economic partnerships that circumvent U.S. constraints.

Such alliances may reshape the global trading landscape, encouraging countries to collectively resist economic pressures from larger nations like the U.S. and China. The unification of these countries could foster stronger regulatory frameworks for trade and investment, reminiscent of the relationships seen in trade agreements like the Trans-Pacific Partnership (TPP). Ultimately, this could redefine geopolitical boundaries and amplify the reshaping of alliances grounded in economic motives rather than purely political ones.

Frequently Asked Questions

What are the potential implications of China tariffs on U.S.-China relations?

China tariffs could exacerbate tensions in U.S.-China relations, leading to increased mistrust and retaliatory measures. As tariffs elevate prices and disrupt supply chains, the trade conflict may prompt China to strengthen ties with traditional U.S. allies, complicating the geopolitical landscape.

How could tariffs impact the U.S. economy and consumer prices?

Tariffs on Chinese imports likely increase prices for American consumers, as businesses face higher costs for goods. This economic strain could lead to broader supply chain disruptions, labor shortages, and inflation, adversely affecting the overall U.S. economy.

What challenges might arise from supply chain disruptions due to China tariffs?

Supply chain disruptions from China tariffs can cause inefficiencies, delays in production, and shortages of goods in the U.S. market. These issues impact not only consumer prices but also the ability of U.S. companies to compete globally and maintain solid relationships with suppliers.

How does China’s trade strategy evolve in response to new U.S. tariffs?

In response to U.S. tariffs, China may adopt a more aggressive trade strategy, focusing on diversifying its export markets and increasing its investments in emerging economies. This could involve leveraging initiatives like the Belt and Road Initiative to expand global trade partnerships.

What are the long-term economic risks of imposing high tariffs on Chinese goods?

Imposing high tariffs on China risks creating a mutually damaging trade environment that could lead to ongoing economic instability. It may weaken U.S. consumer purchasing power, drive inflation, and encourage China to seek alternative alliances, potentially altering global trade dynamics.

How might tariffs affect the technology supply chain and industries dependent on China?

Tariffs could significantly disrupt the technology supply chain, particularly for products like semiconductors and smartphones that rely on Chinese components. This disruption can lead to increased costs, delays in innovation, and a shift towards alternative suppliers, complicating market dynamics.

What is the potential for other countries to fill the void left by China due to tariffs?

Countries like India and Vietnam may emerge as alternative suppliers for U.S. imports as tariffs on China increase. However, elevating their manufacturing capacities to match China’s scale will require time and investment, making the transition challenging.

Can tariffs lead to unintended consequences for U.S.-China relations, particularly in terms of global alliances?

Yes, tariffs could inadvertently strengthen alliances among countries targeted by U.S. tariffs, such as the EU and Australia, allowing China to form strategic partnerships and unify against common economic pressures, potentially isolating the U.S. diplomatically.

What strategies might China deploy to mitigate the impacts of U.S. tariffs?

To mitigate the impact of U.S. tariffs, China could enhance its domestic market efforts, seek new trade agreements with non-U.S. countries, and invest in technological advancements to become more self-reliant and reduce reliance on exports to the U.S.

How do tariffs intersect with the broader context of a trade war between the U.S. and China?

Tariffs are a central tool in the U.S.-China trade war, representing an ongoing conflict over trade practices, intellectual property rights, and market access. This trade war not only impacts bilateral relations but also reshapes global trade patterns and economic strategies.

| Key Point | Details |

|---|---|

| Trade War Impact | Possible resurgence of trade tensions could lead to economic destabilization for both the U.S. and China. |

| Effects on U.S. Economy | Increased tariffs may lead to higher prices for consumers and supply-chain disruptions. |

| Chinese Response | Concerns about the uncertainty of U.S. tariffs and preparing for new negotiations. |

| Potential Benefits for China | Tariffs could allow China to strengthen relationships with U.S. allies affected by tariffs. |

| U.S. Import Alternatives | Countries like India and Vietnam may benefit from China’s diminished role as a supplier. |

| Long-Term Effects | Broad tariffs may damage U.S.-China relations and economic standing further. |

Summary

China tariffs play a crucial role in international trade dynamics, potentially reshaping economic relationships. The proposed tariffs by the U.S. on Chinese goods could lead to significant repercussions, not only for China but for the U.S. economy as well, potentially increasing consumer prices and prompting supply-chain issues. While these tariffs aim to strengthen U.S. economic interests, they may inadvertently empower China to forge stronger ties with U.S. allies, ultimately leading to unintended and lasting damage to America’s global trade position.