The current commercial real estate crisis is posing significant challenges for banks and the broader economy. High office vacancy rates, which have surged since the pandemic, are leading to a concerning decline in property values, particularly in major U.S. cities where vacancies reach up to 23%. This downturn is compounded by the Federal Reserve’s reluctance to lower interest rates, further straining regional banks as a wave of real estate loans come due. Financial experts warn that these pressures could lead to increased delinquencies, potentially endangering the stability of smaller banks and triggering bank failures. As the situation unfolds, the potential ripple effects on the economy have become a focal point for analysts keeping a close eye on these developments.

Currently, the commercial property sector is facing a significant downturn, commonly referred to as the real estate liquidity crisis. With an unprecedented rise in empty office spaces following the pandemic, the demand for commercial properties remains subdued, raising critical concerns among financial institutions and policymakers. The financial vulnerability is particularly pronounced for regional lenders, heavily invested in commercial loans, as rising interest rates exacerbate the economic strain. As stakeholders grapple with the repercussions of this crisis, experts suggest the looming risks associated with bank failures could have lasting impacts on the overall economic landscape. This situation highlights a broader need for strategic interventions to stabilize the affected markets.

Understanding the Commercial Real Estate Crisis

The commercial real estate crisis is primarily a result of surging office vacancy rates following the pandemic. As businesses adopt flexible work arrangements, the demand for downtown office space continues to decline, leading to alarming vacancy rates in major cities, which are hovering between 12% and 23%. This downturn not only depresses property values but also poses significant risks to the banking sector due to the substantial amount of commercial mortgage debt tied to these properties.

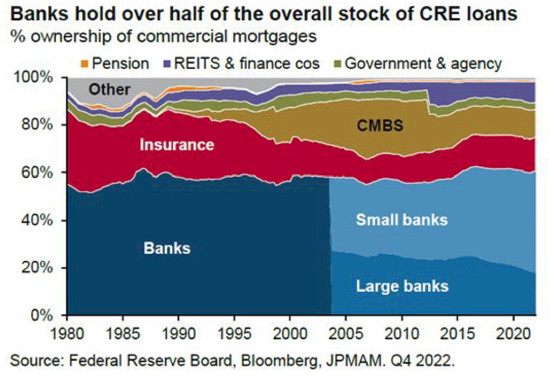

Experts like Kenneth Rogoff have highlighted that approximately 20% of commercial mortgage debt, totaling around $4.7 trillion, is due this year. With lenders exposed to these loans, many firms investing in commercial real estate could see their equity wiped out. While the larger banks are better equipped due to stricter regulations post-2008, smaller and regional banks may face more acute challenges if delinquencies increase. This crisis underscores the fragile interconnectedness between real estate and the financial landscape.

The Impact of Office Vacancy Rates on Regional Banks

High office vacancy rates significantly threaten the stability of regional banks. These institutions often harbor a greater concentration of loans in commercial real estate, meaning they are more vulnerable to market fluctuations. As vacancy rates soar, many commercial properties drop in value, leading to potential defaults on loans. This creates a ripple effect in the banking system where these regional banks may suffer substantial losses, ultimately affecting their lending capabilities and regional economies that depend on their financial health.

If regional banks begin to fail due to unmanageable loan portfolios, the resultant credit crunch could dampen local economic activity. Communities that rely on these banks for residential and commercial loans will likely experience reduced consumption and tighter lending conditions. Thus, while the overall economy might remain robust in some sectors, the localized impacts of failing regional banks could foster economic distress in areas heavily reliant on commercial property.

Effects of Rising Interest Rates on Commercial Real Estate Loans

Rising interest rates exacerbate the commercial real estate crisis as they increase borrowing costs, making it challenging for investors to refinance existing loans. Many investors, who were previously accustomed to low rates, face financial strain as their property values decline alongside high vacancy rates. This imbalance creates a precarious situation where delinquencies on commercial real estate loans could spike, further jeopardizing the financial stability of banks.

Moreover, the Federal Reserve’s hesitance to lower interest rates adds to the uncertainty in the market. As long-term interest rates remain high, refinancing becomes less accessible, leading many investors to struggle with their loan commitments. A continued rise in delinquent loans could create a cascade effect, particularly impacting small and regional banks, which may not have the capital reserves to weather such financial storms.

Potential Consequences for the Broader Economy

The looming crisis in commercial real estate does not just threaten individual banks; it carries broader implications for the U.S. economy. If substantial bank failures occur, the economic repercussions could include reduced credit availability, tighter lending standards, and overall diminished consumer confidence. Regions with distressed banks might experience an economic slowdown as businesses and consumers cut back on spending, potentially leading to a cycle of economic stagnation.

Interestingly, while certain sectors of the economy suffer, such as commercial real estate, other areas continue to thrive, exemplified by a booming stock market. Nonetheless, should projections of economic decline materialize into a significant recession, the fallout for consumers and the economic landscape could be severe, potentially transforming manageable losses into a financial crisis echoing the past.

The Connection Between Bank Failures and Interest Rates

The relationship between bank failures and rising interest rates is critical to understanding the mechanics behind the commercial real estate crisis. As interest rates climb, the value of long-term loans diminishes, leading to increased pressures on banks that hold these loans. Smaller banks, which typically have fewer resources and less diversified portfolios than their larger counterparts, are particularly exposed to the risk of failure under adverse economic conditions caused by rising rates.

Additionally, past experiences have shown that financial institutions often require intervention to avoid wider crises. The Federal Reserve’s previous bailouts exemplify how interconnected the banking system is, and as regional banks face mounting pressures from their commercial real estate exposures, they may rely on similar measures for support. Without adequate regulatory safeguards, the potential for economic destabilization persists as interest rates continue to climb amidst rising delinquencies.

Navigating the Commercial Real Estate Landscape Post-Pandemic

Navigating the post-pandemic commercial real estate landscape requires stakeholders to adapt to changing occupancy trends and economic conditions. As remote work becomes increasingly popular, the demand for traditional office space is shifting, compelling property owners to rethink their strategies. This transitional period is rife with challenges, yet opportunities exist for innovative approaches in property utilization and investment.

Investors might look towards repurposing vacant office spaces into alternative uses, such as residential units or mixed-use developments, despite the regulatory and engineering challenges involved. A shift in focus towards high-demand areas or properties that provide modern amenities may present new avenues for success. However, stakeholders must remain cautious of the broader economic factors, like interest rates and banking stability, which play pivotal roles in determining the viability of their strategies.

Mitigating Risks: Strategies for Investors and Lenders

To mitigate the risks associated with the commercial real estate crisis, investors and lenders must adopt proactive strategies. The importance of thorough due diligence cannot be overstated; understanding market trends, assessing property values, and analyzing tenant demand are critical components of informed decision-making. Investors should consider diversifying their portfolios to hedge against potential downturns in any specific market segment.

Additionally, implementing prudent financial practices—such as reducing leverage and maintaining adequate liquidity—will help investors navigate uncertain economic conditions. Lenders should enhance their risk assessment protocols to account for potential shifts in market dynamics. Establishing clear communication channels with borrowers and providing flexible financing options can likewise prevent defaults and sustain economic flow.

The Need for Regulatory Adjustments in Banking

The current environment underscores the necessity for regulatory adjustments within the banking sector, particularly concerning regional banks. Many of these institutions were less stringently regulated than their larger counterparts, which can lead to heightened risks under economic stress. Ensuring robust capital requirements and risk management practices can bolster their resilience against downturns in commercial real estate and other sectors.

As the Federal Reserve navigates interest rates and potential bank failures, regulatory frameworks must evolve to address the complexities of the modern banking landscape. By fostering a culture of transparency and accountability, regulators can strengthen the banking system against vulnerabilities. Ultimately, carefully calibrated regulatory measures will play a vital role in ensuring the stability of the financial system as it confronts the repercussions of a shifting commercial real estate market.

Long-Term Prospects for Commercial Real Estate

Looking ahead, the long-term prospects for commercial real estate will depend heavily on broader economic recovery trends and interest rate fluctuations. While some regions may witness revitalization as businesses adapt their spatial needs, others, particularly those heavily reliant on traditional office usage, may struggle. Investors must remain vigilant, assessing evolving market demands and potential economic indicators that signal when to pivot their strategies.

Furthermore, the integration of technology in real estate operations, such as virtual tours and enhanced leasing platforms, may facilitate smoother transitions in a changing market landscape. Preparing for future shifts through adaptability and innovation will be essential for key stakeholders in this sector. As recovery processes continue, understanding the interplay of interest rates, regional economies, and consumer behavior will be crucial to navigating the complexities of the commercial real estate market.

Frequently Asked Questions

What impact do high office vacancy rates have on the commercial real estate crisis?

High office vacancy rates contribute significantly to the commercial real estate crisis as they depress property values and diminish rental income for investors. With vacancy rates ranging between 12% to 23% in major U.S. cities, the financial viability of many commercial real estate assets is threatened, leading to potential defaults on loans and a ripple effect throughout the economy.

How could the commercial real estate crisis lead to regional bank failures?

The commercial real estate crisis could strain regional banks significantly, particularly those heavily invested in commercial property loans. As loan delinquencies rise, these banks may face financial instability, similar to what occurred during the last financial crisis. If many loans become delinquent, it could trigger a wave of bank failures within the sector.

Why are rising interest rates a concern during the commercial real estate crisis?

Rising interest rates exacerbate the commercial real estate crisis by increasing borrowing costs for property developers and investors. This situation makes refinancing challenging and increases the likelihood of defaults on existing loans, which threaten lenders’ stability, particularly regional banks that may struggle to absorb these losses.

What factors are contributing to the current commercial real estate crisis?

The commercial real estate crisis is largely attributed to high office vacancy rates post-pandemic, excessive leveraging by investors during low-interest periods, and the impact of rising interest rates. These elements combined have led to a significant downturn in property values and increased risks of loan defaults.

How might the commercial real estate crisis affect the broader economy?

The commercial real estate crisis could lead to tighter lending conditions and reduced consumer spending, particularly in regions where banks face property-related losses. However, its impact may be mitigated by a strong job market and overall economic performance, which can buffer against more widespread economic distress.

What should investors consider amidst the commercial real estate crisis?

Investors should be cautious of the commercial real estate crisis and assess their exposure to office properties, especially those with high vacancy rates. Diversification and strategic investment in resilient asset classes may offer better protection against the risk of further declines and deteriorating economic conditions.

Can policy changes help mitigate the effects of the commercial real estate crisis?

Policy changes, such as adjustments in interest rates or targeted stimulus for regional banks and the real estate sector, may help mitigate the impacts of the commercial real estate crisis. However, the effectiveness of these measures depends on the broader economic context and whether they can facilitate timely refinancing and stabilize property values.

| Key Point | Details |

|---|---|

| High Office Vacancy Rates | Vacancy rates in major U.S. cities range from 12% to 23%, reducing property values. |

| Commercial Mortgage Debt | 20% of $4.7 trillion in commercial mortgage debt is due this year. |

| Potential Bank Impact | Some banks may face losses, especially smaller banks less regulated than larger ones. |

| Comparison to 2008 Crisis | The current situation resembles a slow-moving crisis but is not expected to lead to another 2008-like meltdown. |

| Future Outlook | There is optimism that refinancing could help alleviate pressures if interest rates drop. |

Summary

The commercial real estate crisis poses serious challenges to the U.S. economy, particularly due to soaring office vacancy rates and a massive wave of debt maturities. Although fears of a widespread banking failure loom, experts suggest that the situation may not lead to a full-blown financial meltdown akin to 2008. The losses in commercial real estate, driven by changing workplace dynamics and higher interest rates, could affect regional banks and consumers alike. However, the overall economic outlook remains solid, with a booming stock market and low unemployment. Thus, while the commercial real estate sector grapples with significant issues, the broader economy may still demonstrate resilience.