Can Trump fire Fed chairman Jerome Powell? This question has reignited debates around the delicate balance of power between the President and the Federal Reserve. The potential for Powell’s removal raises critical concerns about the independence of the Federal Reserve, a cornerstone of U.S. monetary policy. If Trump were to pursue this course of action, the negative impact of Fed chair removal could ripple through the markets, triggering widespread volatility. Understanding the dynamics of the Jerome Powell Trump relationship is essential for gauging how such a move might influence investor sentiment and market expectations.

The inquiry into whether Trump can dismiss the Federal Reserve chair pivots on broader themes of executive power and institutional autonomy. Viewed through the lens of central banking, the debate underscores the importance of maintaining Federal Reserve independence amidst political pressures. This independence is not merely a bureaucratic nicety; it serves a vital function in stabilizing economic policy, especially amid fluctuating market conditions. As discussions around the Jerome Powell Trump dynamic unfold, investors remain keenly aware of the potential ramifications for monetary policy and the subsequent market reaction to any changes at the helm of the Federal Reserve.

Can Trump Fire the Fed Chairman?

The question of whether President Trump can fire Federal Reserve Chairman Jerome Powell has sparked considerable debate among legal experts and economists alike. Although the Federal Reserve Act does allow for the removal of governors under specific circumstances, it is less clear whether this applies to the chairperson. Trump’s public dissatisfaction with Powell’s approach to interest rates has led to speculation about a potential removal, which could further complicate an already tumultuous relationship. Experts caution that such a move might undermine the Federal Reserve’s independence, a cornerstone of U.S. monetary policy, which could have significant implications for economic stability.

The constitutional interpretation regarding the president’s power to dismiss officials at independent agencies like the Federal Reserve is complex. In recent years, the Supreme Court has indicated an erosion of the longstanding protection for independent agencies established in prior rulings. Still, it remains an uncertain area, with some justice hints suggesting that the Federal Reserve may be treated differently than other agencies. This ambiguity creates a precarious situation, where any attempt by Trump to oust Powell could lead to significant legal battles and market turmoil.

Impact of Fed Chair Removal on the Markets

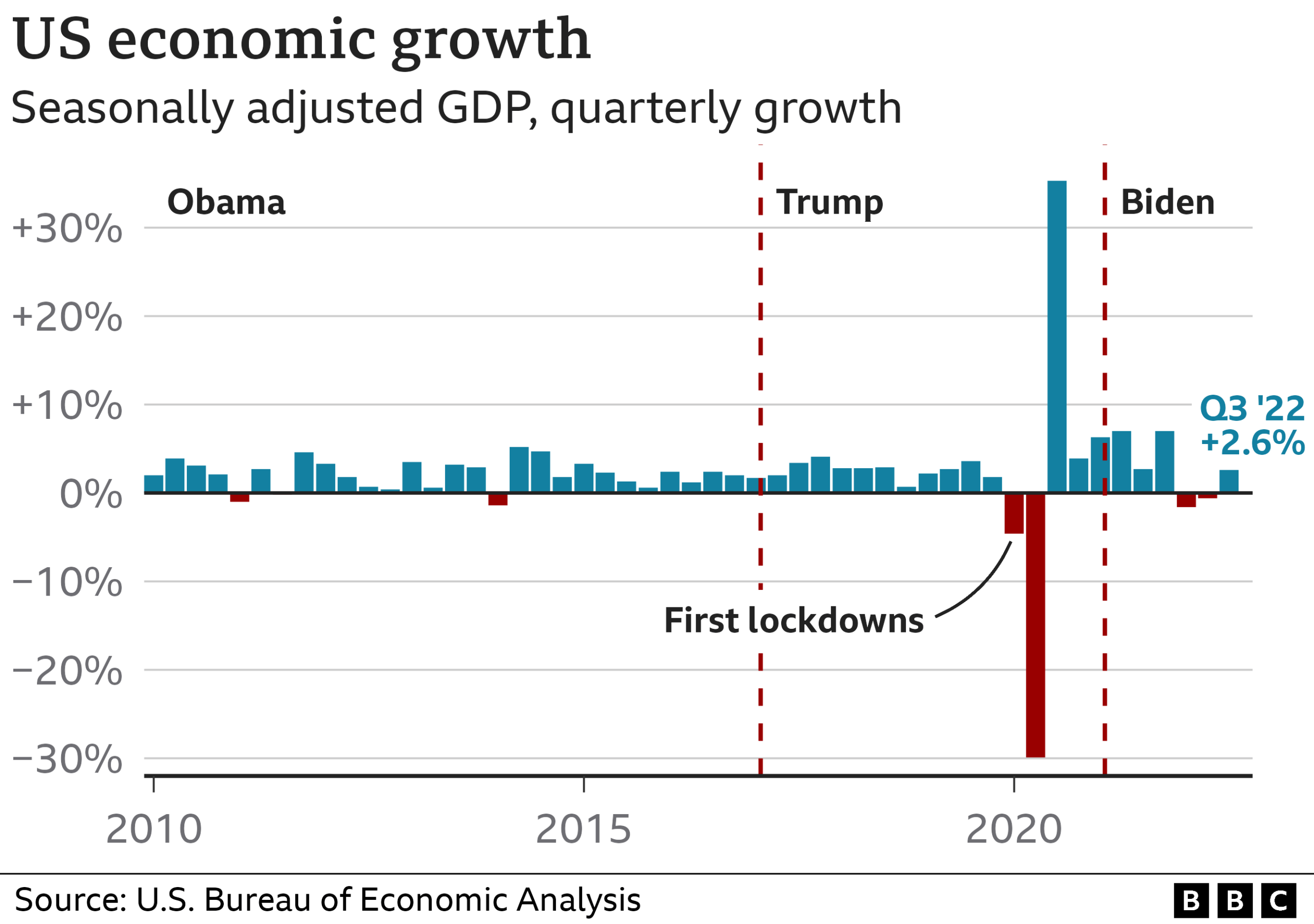

Market reactions to the potential removal of a Fed chairman can be profound, driven by fears of altered monetary policy. Investors rely on the Fed’s independence to gauge the stability of economic growth and inflation. Concerns about Trump’s intent to impose a looser monetary policy through the replacement of Powell could create an environment of uncertainty, prompting investors to adjust their strategies. Historical patterns suggest that whenever central bank personnel changes occur, particularly in politically charged circumstances, market volatility often increases as traders react to shifting signals regarding interest rates and growth forecasts.

Furthermore, a transition in leadership at the Federal Reserve could signal to markets an impending change in monetary policy direction, which investors may view as inflationary. A proactive response from the market could manifest in rising long-term interest rates as a risk premium for holding debt securities increases. Consequently, the removal of Powell could force the Fed into a reactive position, distancing it from its commitment to independent monetary policy, thereby affecting the overall economic landscape.

The Relationship Between Trump and Powell

The relationship between President Trump and Jerome Powell has been marked by tension, particularly due to divergent views on interest rates and their impact on America’s economic recovery. Trump has often criticized Powell for not being aggressive enough in cutting rates, which he believes is necessary for sustained economic growth. This public friction sets a concerning precedent for the independence of the Federal Reserve, highlighting the delicate balance between political influence and fiscal governance. As the Fed Chair, Powell faces the dual challenge of maintaining his independence while also addressing the administration’s economic concerns.

In this context, discussions about Trump potentially firing Powell underscore the risks associated with a politicized central bank. Observers note that such a decision could lead to a loss of credibility for the Fed, which is essential in managing inflation expectations and fostering market confidence. Understanding the underlying dynamics of the Trump-Powell relationship is crucial for assessing how future policy decisions by the Fed will be interpreted in the arena of global finance.

Federal Reserve Independence and Its Challenges

Federal Reserve independence is fundamental to credible monetary policy, allowing it to resist short-term political pressures in favor of long-term economic stability. The challenges facing this independence have been amplified by increasing political scrutiny and the potential for executive intervention. As outlined by experts, any attempt by Trump to remove Powell could challenge the very framework that has reinforced the Fed’s ability to function without political influence. Such actions may signal to the public and markets that monetary policy could be subject to political whims.

Moreover, the Fed’s independence is not merely a matter of legal standing; it plays a crucial role in market confidence. An erosion of this independence could lead to increased risk premiums and higher borrowing costs for consumers and businesses alike. Maintaining a clear divide between the Fed’s policy decisions and political agendas is essential to safeguard the institution’s effectiveness in managing inflation, thus stabilizing economic growth over the long term.

Market Reaction to Federal Reserve Changes

Market reaction to changes at the Federal Reserve is often swift and significant, as investors seek to understand the implications for monetary policy. The prospect of Jerome Powell’s removal has already stirred anxiety among traders, given the Fed’s central role in navigating economic uncertainties. Historical data indicates that changes in leadership or policy direction at the Fed typically lead to fluctuations in equity markets, bond prices, and even currency valuations, as traders reassess risk.

The recent discourse around Powell’s position can be linked to broader concerns about inflation and interest rates. If markets perceive a potential shift towards a more accommodative policy due to a change in leadership, they may react by selling off riskier assets or driving up yields on government securities. Understanding these market dynamics is crucial for investors looking to navigate the complexities brought on by possible upheavals within the Federal Reserve.

Legal Framework Surrounding Fed Chair Dismissal

The legal framework surrounding the removal of a Federal Reserve chair is complex and subject to varying interpretations. The Federal Reserve Act specifies conditions under which governors may be removed, primarily ‘for cause,’ yet it remains ambiguous whether this applies to the chair. Legal experts highlight that ambiguity has led to different opinions about the president’s authority in such matters, particularly given recent Supreme Court decisions that appear to challenge the strength of ‘for cause’ protections.

Any legal attempt to dismiss Powell would likely invite extensive litigation, raising questions about executive power and the Constitution’s implications on independent agencies. As past decisions have indicated, the Supreme Court has begun to reevaluate long-held doctrines regarding removal protections, creating a precedent that could impact how the Fed operates in the future. The outcome of such legal confrontations could have profound consequences, not only for Powell’s tenure but also for the Federal Reserve’s long-term independence.

Potential Candidates for Powell’s Replacement

Should President Trump choose to pursue the dismissal of Jerome Powell, market analysts speculate on who could succeed him as Fed Chair. The identity of a potential replacement could send strong signals to the market regarding future monetary policy directions. Analysts stress that if Trump were to nominate a candidate perceived as favoring aggressive interest rate cuts, it could lead to significant upward pressure on long-term yields as investors reassess risks and inflation expectations.

However, the concern among market participants is that a successor might carry the stigma of political influence, undermining the Fed’s credibility and independence. This uncertainty could amplify market fears, leading to heightened volatility and altered risk assessments in financial markets. Ultimately, the choice of Powell’s successor would need to navigate the delicate balance of maintaining Fed independence while aligning with administration goals.

The Future of Federal Reserve Under Political Pressure

As political pressures mount around the Federal Reserve, questions arise about its future trajectory and the implications for U.S. monetary policy. The ongoing discourse on whether Trump can fire Powell reflects deeper concerns about the central bank’s independence amidst growing political temperatures. Market observers argue that any perceived encroachment on the Fed’s autonomy could lead to prolonged periods of uncertainty, ultimately destabilizing the economy at a crucial juncture.

To preserve the integrity and credibility of the Federal Reserve, experts emphasize the need for clearly defined boundaries around its operations and decision-making processes. Strengthening institutional independence may require the incorporation of broader legal safeguards to protect against political interference, particularly in a dynamic environment where economic conditions are vulnerable to rapid changes.

Conclusion: Navigating the Future of Monetary Policy

In conclusion, the question of whether Trump can fire the Federal Reserve’s chairman taps into broader themes of political authority and central bank independence. The crossroads faced by the institution today reflects the tension between political considerations and sound economic governance, which could reshape how monetary policy is conducted in America. Continuous dialogue among policymakers, economists, and the public is essential to navigate these challenges, ultimately ensuring that the Federal Reserve remains focused on its primary mandates.

As we look toward the future, proactive measures to strengthen the Federal Reserve’s independence could mitigate potential shocks emanating from political maneuvering, fostering a climate of trust within financial markets. This trust is integral for maintaining economic stability and growth, allowing the Federal Reserve to fulfill its critical role in managing inflation and fostering maximum employment.

Frequently Asked Questions

Can Trump fire Federal Reserve Chairman Powell and what would that mean for the Fed’s independence?

While President Trump could technically seek to remove Federal Reserve Chairman Jerome Powell, doing so would raise significant concerns regarding the Federal Reserve’s independence. The Federal Reserve Act permits governors to be removed for cause, but the chair’s status and protections are ambiguous. Analysts warn that such an action could undermine market trust in the Fed and its ability to maintain stable monetary policy.

What is the potential impact of Fed chair removal on the markets?

If Trump were to fire Fed Chairman Powell, the immediate market reaction would likely be negative, as investors may see the removal as a signal for looser monetary policy, which could lead to higher inflation expectations. This fear could drive up long-term interest rates significantly, shaking confidence in the Fed’s independence and its credibility as an inflation fighter.

What do analysts say about Trump’s relationship with Jerome Powell?

President Trump’s relationship with Jerome Powell has been tense. Trump has publicly criticized Powell for not lowering interest rates aggressively enough to support economic growth. Despite considering Powell’s removal, many analysts suggest that market reactions may deter Trump from taking such a drastic step, as it could destabilize the economy further.

What legal arguments exist regarding Trump’s ability to remove a Fed chair?

There are complex legal arguments surrounding Trump’s ability to fire Jerome Powell. The Federal Reserve Act does not explicitly state the conditions under which the chair can be removed, focusing instead on governors. Legal experts contend that any removal attempt could face substantial constitutional challenges, particularly concerning the independence of the Fed and executive authority.

How would Wall Street react to Jerome Powell’s potential removal by Trump?

Wall Street would likely react negatively to any move by Trump to remove Jerome Powell, anticipating a more accommodative monetary policy that could lead to increased inflation and destabilization of financial markets. Investors fear that such a move would compromise the Fed’s independence, further eroding trust and resulting in higher long-term interest rates.

| Key Point | Details |

|---|---|

| Trump’s Relationship with Powell | President Trump and Fed Chair Jerome Powell have a contentious history. Trump often criticized Powell for not being aggressive enough in cutting interest rates. |

| Legal Framework for Dismissal | The Federal Reserve Act allows governors to be dismissed for cause; however, ambiguity exists about the chair’s protections regarding removal. |

| Supreme Court’s Position | Recent Supreme Court rulings may suggest a shift in the interpretation of presidential removal power over independent agency heads like the Fed chair. |

| Market Reactions | Market analysts predict severe negative reactions if Powell were to be removed, fearing instability in the Fed’s independence and its economic implications. |

| Impact of Powell’s Tenure | The impact of the Fed chair on monetary policy is profound, but the chair must work to build consensus within the Fed board. |

| Future Succession Impact | If Powell’s term ends, the choice of his successor will greatly affect market confidence based on perceived intentions for monetary policy. |

Summary

Can Trump fire Fed chairman? The answer is complex and uncertain, heavily influenced by legal interpretations and market conditions. While Trump has hinted at removing Powell, such an action could undermine the Federal Reserve’s independence and lead to significant market turmoil. The gravity of the situation underscores the importance within the current economic landscape, where the Fed’s credibility is crucial for stability. Ultimately, market reactions may serve as a deterrent to any impulsive actions regarding Powell’s position.