Rick Scott tariffs have emerged as a contentious issue in defining U.S. trade policy, particularly amid ongoing US-China trade tensions. As a prominent advocate of the Trump administration’s economic policy, Scott argues that imposing tariffs on foreign goods will benefit American workers by leveling the playing field against international competitors. This approach promises to reshape decades of trade policy changes, helping to reduce trade deficits and bolster U.S. manufacturing. However, the impact of these tariffs on the economy remains a subject of debate, with economists warning against potential adverse effects such as inflation and market volatility. In a recent discussion, Scott defended these tariffs as an essential strategy for protecting American interests, positioning them as a vital tool in the broader economic landscape.

The tariffs proposed by Senator Scott represent a pivotal move in America’s approach to international trade and economic relationships. These protective measures are aimed at countering market disadvantages faced by U.S. industries due to aggressive foreign policies. Historically, tariffs have been used as a leverage point in trade negotiations, particularly in light of the complex dynamics with nations like China. The implications of Rick Scott’s tariffs extend beyond mere policy; they touch on economic stability, the potential for inflation, and a re-examination of America’s trade agreements. As such, the current dialogue surrounding tariffs is not just about economics but also encompasses national security and international diplomacy.

Understanding Rick Scott’s Tariff Strategy

Senator Rick Scott’s tariff strategy is rooted in a desire to create a more equitable trade environment for American workers. By advocating for tariffs, Scott believes that the balance of trade can be tilted back in favor of the U.S. economy. He argues that the tariffs imposed by the Trump administration are not merely punitive measures but are strategic tools designed to compel countries, particularly China, to lower their own trade barriers on American goods. Scott contends that this approach will level the playing field, ensuring that American workers are not outmatched by foreign competition that benefits from lower tariff rates.

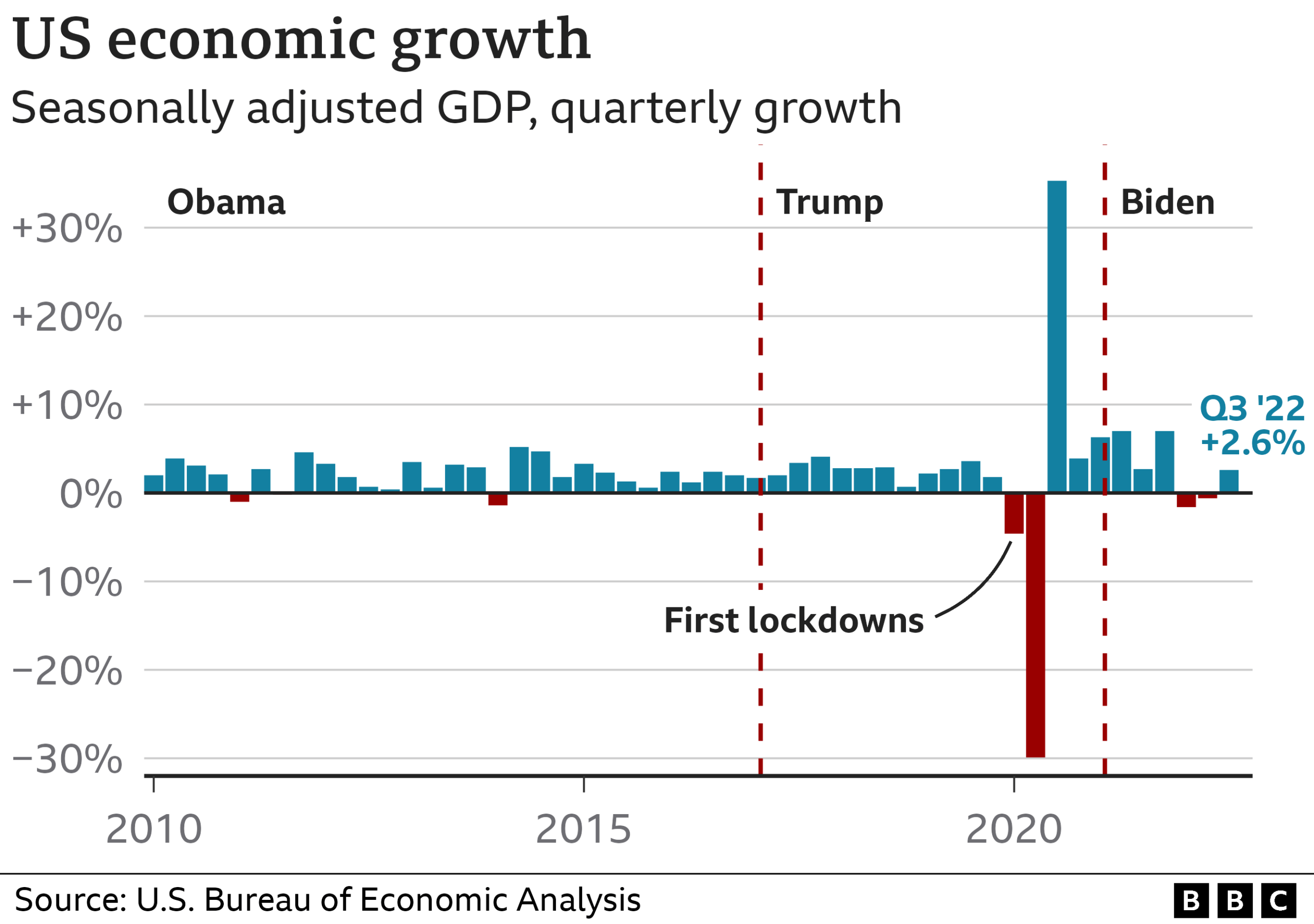

Despite his strong support for tariffs, the economic consequences of such bold policy changes are subjects of heated debate. Critics argue that these tariffs could lead to increased costs for consumers and hurt American businesses that rely on imported goods. Economists like Jason Furman warn that the long-term repercussions may include a contraction in GDP, as seen in early 2025, and potential inflationary pressures as the market adjusts. Nonetheless, Scott remains optimistic that American manufacturers will thrive in a scenario with reduced foreign competition, as he emphasizes the need for a robust manufacturing sector to sustain economic growth.

The Economic Impact of Tariffs on the U.S. Market

The economic impact of tariffs on the U.S. market is multifaceted and shapes various sectors differently. On one hand, tariffs can protect domestic industries from international competition, giving American manufacturers an opportunity to grow and sustain jobs. However, the recent 10 percent tariffs enacted against various nations, along with the staggering 145 percent tariff imposed on China, have caused significant disruption in supply chains. This oscillation increases uncertainty among investors and can lead to volatility in stock markets, ultimately translating into economic contraction and reduced consumer spending power.

As evidenced by the $6 trillion loss in the stock market linked to these trade conflicts, the tariffs enacted under Scott’s endorsement of Trump administration policies illustrate a complex relationship with the economy. While some firms may benefit from the enhanced protection against foreign competitors, others face increased raw material costs and diminished profit margins, which could lead to layoffs and reduced hiring. The overarching consequence of such trade policy changes may ultimately lead to a more fragmented global economy, as countries retaliate with their own tariffs in a tit-for-tat manner, further complicating international trade dynamics.

Rick Scott’s Perspective on U.S.-China Trade Tensions

Rick Scott views the trade relationship with China through a lens of heightened caution, perceiving the nation as a formidable competitor to U.S. economic interests. He believes that engagement in trade with China poses risks not only to American workers but to national security as well. His assertion—that avoiding war with China hinges on undermining its economic strength—reflects a hardline stance that prioritizes American economic independence and stability over global interdependence.

This perspective on U.S.-China trade tensions underscores a critical debate among policymakers about the effectiveness of tariffs as a bargaining chip in trade negotiations. Scott argues that if tariffs can decimate China’s economy, the U.S. will be in a stronger position to negotiate favorable trade terms. However, many economists contend that such aggressive policies can backfire, ultimately leading to retaliatory measures that harm American businesses and consumers. As the U.S.-China relationship continues to evolve, the implications of Scott’s views could shape the future landscape of international trade.

Evaluating the Broader Implications of Tariffs

The broader implications of tariffs extend beyond immediate economic impacts; they also encapsulate shifts in global trade policy. With countries reassessing their strategies in light of the aggressive trade measures championed by figures like Rick Scott, the landscape of international commerce is becoming increasingly transactional and competitive. These policy changes prompt countries to rethink their reliance on free trade mechanisms, potentially moving towards a more protectionist approach as nations prioritize domestic industries amidst rising global tensions.

Furthermore, the potential isolation of the U.S. in global markets poses risks of decreased trade partnerships and collaborations. As tariffs impact economic dynamics, businesses adjust their markets and sourcing strategies, which could lead to longer-term shifts in supply chains and product pricing. Such extensive trade policy changes influence not just economic figures but also diplomatic relations, workforce dynamics, and consumer behavior, raising questions about the sustainability of the current competitive model championed by Scott and others.

Rick Scott’s Economic Policy Vision

Rick Scott’s vision for economic policy revolves around empowering American workers through initiatives aimed at enhancing manufacturing resilience and competitiveness in global markets. Central to this vision is his staunch support for tariffs as a strategy to protect local jobs and stimulate production within the United States. Scott believes that strong tariff protections allow for a revival of industries that have been outsourced or diminished due to more favorable foreign trade conditions, with the ultimate goal of strengthening the American economy.

Critics of Scott’s economic policy approach may cite concerns about the long-term impacts of such protective measures. Trade experts suggest that while tariffs could offer short-term relief to certain sectors, they may inadvertently push consumers towards higher prices and lower choices, creating an economic backlash. Thus, while Rick Scott’s economic policy reflects a dedicated commitment to prioritizing U.S. interests, it must also grapple with the broader implications of elevated tariffs and their influence on the overall economy.

The Impact of Tariffs on American Workers

Understanding the impact of tariffs on American workers is crucial to grasping the full consequences of current trade policies. Proponents like Senator Rick Scott argue that tariffs will protect jobs by reducing the influx of foreign products that compete with domestic goods. By imposing higher taxes on imports, Scott envisions a surge in manufacturing jobs as companies shift their focus back to the U.S. market, ultimately benefiting American employees by creating more job openings and promoting fair wages.

However, the counter-argument highlights the potential downsides, particularly if tariffs lead to retaliatory actions from trading partners. This could escalate into trade wars, which may harm American workers in industries reliant on international trade and supply chains. For instance, industries that import materials could face increased costs, potentially leading to job losses if they cannot pass these costs onto consumers. The real challenge lies in balancing protectionist measures with the need for strategy that promotes growth across various sectors.

Current Trends in U.S. Trade Policy

The current trends in U.S. trade policy reveal a significant shift towards protectionism, with tariffs becoming the favored tool for managing international trade relationships. Led by politicians like Rick Scott, this shift has been driven by the rhetoric surrounding national security and economic independence. Tariffs are now viewed as necessary to curtail the economic dominance of rival nations, especially China, which has become a focal point of U.S. trade policy changes. This new approach has sparked discussions about its long-term viability and effectiveness in fostering healthy economic competition.

One trend that emerges from this evolving trade policy is the growing skepticism of free trade agreements. Lawmakers and economists are increasingly scrutinizing older agreements that may disadvantage U.S. businesses and workers. In this climate, Scott’s advocacy for tariffs highlights a critical reassessment of what constitutes fair trade, underscoring the necessity to reevaluate how these policies affect both domestic manufacturing and global economic partnerships. As the U.S. navigates these changes, the focus will likely be on finding common ground where American interests can thrive while still maintaining essential global relationships.

Potential Economic Consequences of Tariff Implementation

Implementing tariffs inevitably gives rise to various economic consequences, making it essential for policymakers like Rick Scott to carefully consider their implications. Tariffs can serve as a double-edged sword; while they may offer short-term protection for specific industries and create a surge in local jobs, they can also trigger inflationary pressures as consumer goods’ prices increase. A common concern is that, as U.S. manufacturers rely on imported components, tariffs can lead to rising production costs, which may ultimately be passed on to consumers.

Moreover, the broader macroeconomic landscape may experience strain as trade volume declines due to heightened barriers. As countries respond with their own tariffs, the interconnectedness of the global economy means that U.S. exports could also suffer negative effects. In this context, Scott’s policies should be closely monitored to gauge their effectiveness in stimulating U.S. manufacturing without inadvertently triggering a domino effect of negative trade relations and economic consequences.

The Future of Trade Agreements in the U.S.

The future of trade agreements in the U.S. is becoming increasingly complex as the political landscape shifts towards favoring protectionist policies like those advocated by Rick Scott. With the implications of tariffs steering the direction of trade discussions, the U.S. may be moving away from traditional multilateral agreements to a more unilaterally driven approach. This change highlights a growing sentiment in favor of negotiating terms that directly benefit the American economy, especially in light of concerns regarding competing nations like China.

As the administration grapples with these new policies, the potential for future trade agreements will likely focus on establishing clearer terms that prioritize U.S. interests over unfettered globalization. Legislators will need to navigate between the pressures of domestic economic protectionism and the demands for maintaining stable international relationships. Scott’s views may shape these upcoming negotiations, pushing for arrangements that curtail foreign competition while aiming to revamp America’s standing in global trade.

Frequently Asked Questions

What are Rick Scott’s views on tariffs and their impact on the economy?

Senator Rick Scott argues that tariffs are essential for leveling the playing field for American workers. He believes that by imposing tariffs, the U.S. can incentivize other nations to lower their own trade barriers, ultimately benefiting U.S. producers and the economy. Scott supports the Trump administration’s tariff strategy, claiming it will help enhance American competitiveness on a global scale.

How do Rick Scott tariffs relate to trade policy changes in the U.S.?

Rick Scott’s tariffs align with significant trade policy changes initiated during the Trump administration, which aimed to reshape global trading dynamics. By advocating for higher tariffs, especially against countries like China, Scott seeks to reduce trade deficits and protect U.S. manufacturers. These policy changes reflect a more aggressive approach to international trade.

What are the potential effects of the tariffs imposed under Rick Scott’s economic policy?

The tariffs promoted by Rick Scott are designed to protect American jobs and encourage domestic production. However, economists warn that such tariffs could lead to increased prices for consumers and potential economic downturns. Scott believes that, in the long run, these tariffs will bolster U.S. economic strength by forcing nations like China to reconsider their trade practices.

How have Rick Scott tariffs influenced US-China trade tensions?

Rick Scott tariffs have significantly escalated US-China trade tensions, especially with the implementation of a 145% tariff on Chinese imports. This aggressive stance is part of Scott’s broader strategy of containing China’s economic influence, which he views as a threat to U.S. security and economic integrity. In response, China has also raised tariffs on U.S. goods, further complicating trade relations.

What criticisms exist regarding Rick Scott’s stance on tariffs?

Critics, including economists like Jason Furman, argue that Rick Scott’s tariffs may harm the U.S. economy by stifling growth and leading to inflation. They contend that a more diplomatic approach, involving negotiations rather than unilateral tariffs, could have mitigated some economic risks and fostered better international relations.

Can Rick Scott’s tariffs lead to inflation?

While Senator Rick Scott is uncertain about the direct impact of his tariffs on inflation, many economists suggest that tariffs could contribute to rising consumer prices. The relationship between tariffs and inflation is complex, and Scott believes that controlling inflation requires balancing the budget, regardless of tariffs.

| Key Points | Details |

|---|---|

| Rick Scott’s Support for Tariffs | Defends the Trump administration’s tariff strategy as a means to help U.S. workers and eliminate barriers on American products. |

| Impact on Global Economy | The implementation of tariffs has caused fluctuations in global stock markets and a notable contraction in GDP. |

| Scott’s View on China | Considers China the biggest economic threat and advocates for minimal trade with them to avoid future conflict. |

| Economic Disagreements | Economists, including Jason Furman, argue that the tariffs will harm the U.S. economy, contrary to Scott’s beliefs. |

| Tariff Rates | Most nations face a 10 percent tariff, while China is subjected to a 145 percent tariff, prompting China’s retaliatory actions. |

| Scott’s Perspective on National Debt | Emphasizes the need for a balanced budget and reduced spending to improve fiscal conditions amid rising national debt projections. |

Summary

Rick Scott tariffs represent a bold approach to reshaping U.S. trade policy by aiming for fair competition for American workers. While Scott believes these tariffs are essential for promoting U.S. manufacturing and mitigating trade deficits, they have sparked significant debate over their impact on the economy, particularly concerning inflation and global trade relations. The stark contrast in tariffs between the U.S. and China further highlights the tensions in international trade dynamics, with Scott prioritizing a robust stance against what he views as economic threats from nations like China.