Harvard research funding plays a crucial role in sustaining innovation within the U.S. economy, particularly in the realms of scientific research and entrepreneurship. The recent federal funding freeze threatens not only the university’s groundbreaking studies but also the financial backbone that supports countless startups and venture capital initiatives. As Harvard navigates these tumultuous waters, the repercussions on the startup ecosystem could be profound, potentially stifling economic growth. This pivotal funding directly influences Harvard’s ability to convert scientific discoveries into marketable solutions through innovation-driven startups. Therefore, understanding the implications of Harvard research funding is vital for grasping the future landscape of American entrepreneurship and technology.

In the realm of higher education, funding for research activities at prestigious institutions like Harvard is fundamental for fostering economic advancement and entrepreneurial spirit. This financial support not only enhances scientific exploration but also serves as a catalyst for developing innovative startups that are essential for driving growth in the U.S. economy. The interconnection between venture capital investment and research conducted in such prestigious universities underscores the importance of a robust funding system. As federal funding for initiatives in science, technology, and medicine faces potential cuts, the broader implications for the innovation ecosystem and entrepreneurial activities are stark and multifaceted. Ultimately, the ability of research institutions to nurture new ventures and technological advancements hinges significantly on sustained funding.

The Importance of Harvard Research Funding in Innovation

Harvard research funding plays a pivotal role in fostering innovation within the U.S. startup ecosystem. The financial support that research universities receive is integral for advancing scientific discoveries, which serve as the foundation for many startup ventures. Harvard’s rich array of labs, which include the Wyss Institute and the Broad Institute, produces groundbreaking research in fields like technology and medicine. Without adequate funding, the continuity of these vital research projects is jeopardized, stifling the creation of innovative startups that drive economic growth.

Moreover, the interconnection between federal funding and research capabilities cannot be overstated. When funding is cut, as seen in recent governmental actions against universities, the immediate consequence is not just a loss of research, but a potential slowdown in the entire entrepreneurial landscape. Startups rely on the research conducted in prestigious institutions like Harvard for ideas, technology transfer, and expertise. Hence, the freezing of grants threatens not only Harvard’s research output but also the broader ecosystem that nurtures entrepreneurship.

How Federal Funding Cuts Impact the Startup Ecosystem

Federal funding is the lifeblood of scientific research, particularly in tech and biomedical fields, which are crucial for incubating startups. Cuts to research budgets can lead to delayed projects, reduced hiring, and ultimately, fewer startups emerging in the long run. When universities face funding disruptions like those currently impacting Harvard, the ripple effect can destabilize the synergy between academia and the venture capital ecosystem. This threatens the very foundation upon which new companies are built, as they often rely on university-led innovations to forge new paths in industry.

Additionally, the impact of funding cuts extends beyond immediate financial constraints. It can alter the talent pipeline essential for startups. High-caliber students drawn to institutions known for their research, like Harvard, may be deterred from pursuing entrepreneurship if they perceive a less supportive environment. Consequently, the future of the startup ecosystem may hinge on reinstating stable research funding that regularly feeds into the venture capital landscape.

Entrepreneurship and the Role of Research Universities

Research universities are paramount in shaping the entrepreneurial landscape. They provide a breeding ground for new ideas, where faculty and students actively engage in pushing the boundaries of scientific knowledge. Harvard, known for its robust entrepreneurship curriculum, enables aspiring entrepreneurs to not only gain theoretical insights but also practical experience in translating research into market-ready solutions. This dual approach amplifies their potential to contribute to economic growth.

As students collaborate with faculty members on innovative projects, they often identify commercial opportunities arising from their academic work. Many successful startups have roots in university projects, highlighting how essential research universities are to entrepreneurship. By nurturing talent and fostering a culture of innovation, institutions like Harvard play a key role in ensuring that the startup ecosystem remains vibrant and responsive to the demands of the modern economy.

The Economic Implications of Research Funding Disruptions

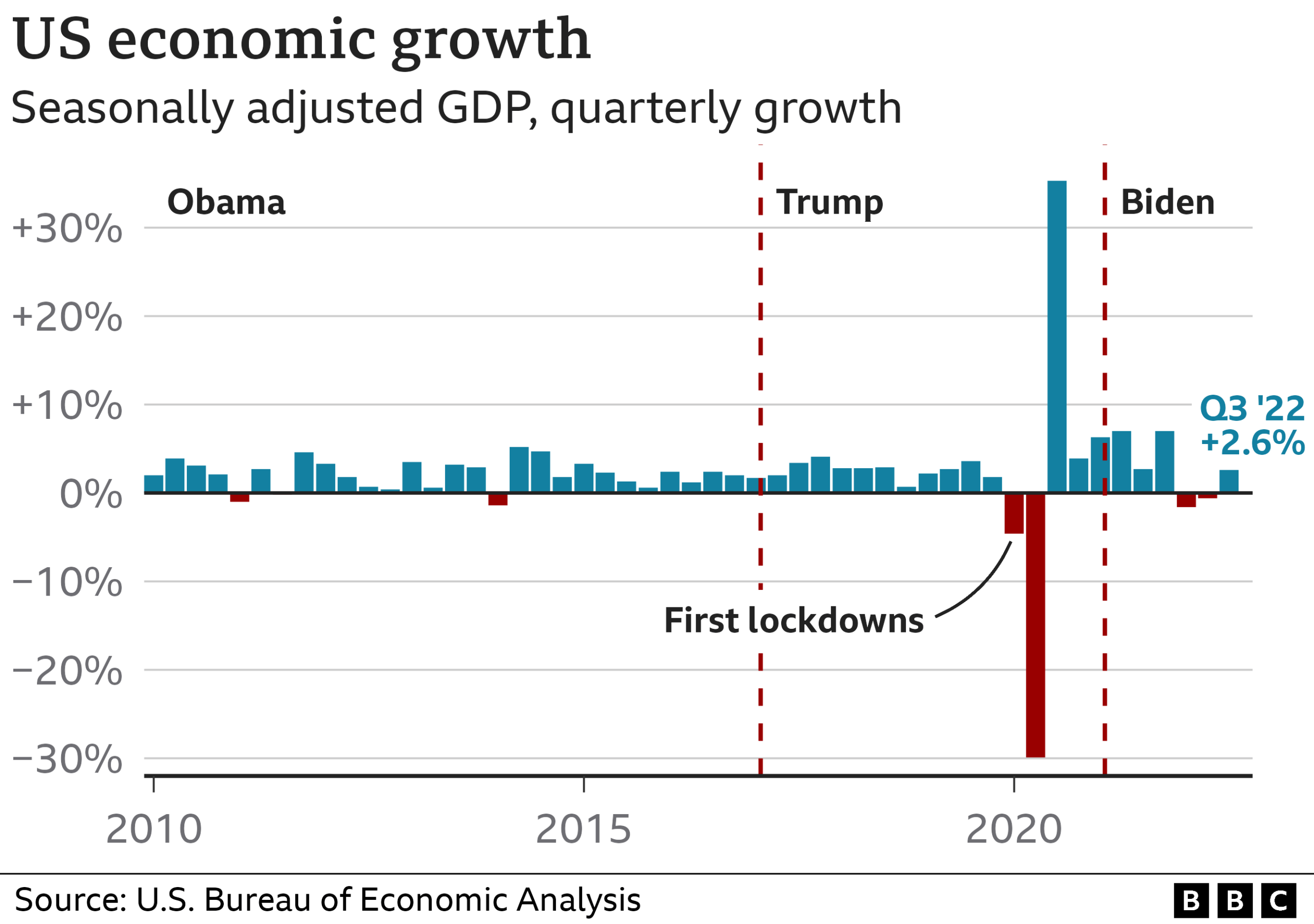

The economic ramifications of disrupted research funding are profound and far-reaching. According to recent analyses, an anticipated reduction in research funding at prestigious institutions such as Harvard could lead to a significant contraction of the U.S. gross domestic product (GDP), reminiscent of economic downturns like the 2008 recession. This stark prediction underscores the linkage between scientific research and overall economic health, illustrating how cuts to funding can stifle progress and innovation at a national level.

Furthermore, the economic consequences extend to the startup community, which thrives on innovation driven by robust research outputs. When funding is limited, the potential for breakthroughs diminishes, leading to fewer startups emerging from university settings. This ultimately results in a weakened entrepreneurial ecosystem, less investment from venture capital, and impaired economic growth. Protecting research funding is not merely an academic concern but a crucial economic strategy vital for sustaining the nation’s competitive advantage.

Navigating the Future of Startups Amid Funding Cuts

As startups face the potential fallout from funding cuts, navigating this challenging landscape becomes critical. Entrepreneurs must adapt and seek alternative funding sources or explore partnerships with private investors who value innovation and long-term sustainability. Startups that can pivot quickly and demonstrate resilience are more likely to weather the storm during difficult funding times, though it requires a proactive approach.

Moreover, fostering collaborations across sectors—be it between universities and industry partners or between startups and venture capital firms—can help to create new pathways for funding and innovation. This collaborative spirit can lead to diversified funding strategies that minimize reliance on government grants and bolster the startup ecosystem as a whole. Looking ahead, it’s essential for stakeholders in the startup community to advocate for the restoration of research funding and continuously explore innovative paths for financial viability.

The Link Between Science Research and Economic Growth

The correlation between scientific research and economic growth is well-documented, as research stimulates innovation which, in turn, leads to new technologies and businesses. Federal funding for scientific research acts as a catalyst that drives educational institutions to produce high-impact research outcomes, directly influencing the economy. By investing in scientific research, the government not only supports the development of cutting-edge technologies but also fosters a dynamic entrepreneurial ecosystem.

Moreover, the contributions of successful startups emerging from research breakthroughs extend beyond financial returns; they create jobs, enhance productivity, and promote long-term economic stability. Thus, maintaining robust funding for scientific research is not merely an academic concern but a strategic economic imperative that influences the overall health and vitality of the economy.

Impact of Disrupted NIH Research Funding

The cessation of federal funding for the National Institutes of Health (NIH) has significant repercussions for scientific research and the subsequent development of startups in the tech and biomedical sectors. As institutions like Harvard grapple with frozen grants, the immediate fallout includes postponements in ongoing projects, difficulties in attracting top talent, and fewer commercial opportunities for students and researchers. The direct correlation between NIH funding and the pace of innovation cannot be ignored.

Additionally, the halting of previously approved grant payments stalls critical research that could lead to breakthroughs in medicine and technology. This disruption heightens the challenge for startups eager to leverage new scientific advancements, potentially dampening their growth and reducing their chances of success. The hope remains that as awareness of these issues grows, there will be a push to reinstate funding and rejuvenate the research landscape, so startups can continue to thrive.

The Future of Entrepreneurship in a Challenging Funding Environment

Looking ahead, the future of entrepreneurship faces uncertainty due to the potential long-term ramifications of research funding interruptions. While the immediate impact may be less visible, the effects of these funding freezes will likely resonate through the startup pipeline for years to come. As the entrepreneurial landscape relies heavily on continuous innovation arising from research, sustained funding is crucial for maintaining a cycle of innovation that supports new ventures.

Startups that emerge in such an environment will need to be particularly resilient, adapting their business models and seeking non-traditional financing avenues. The emphasis on creativity and resourcefulness will likely define the next wave of entrepreneurs who can capitalize on limited resources while still pushing the boundaries of innovation. Therefore, supporting research funding becomes vital not just for academia but also for the future of entrepreneurship and economic advancement.

The Role of Entrepreneurs in Sustaining Research Funding

Entrepreneurs undoubtedly play a critical role in advocating for sustained research funding, as their success stories often illustrate the tangible benefits of funding innovation. By showcasing how their ventures were born from research at institutions like Harvard, they can rally public and governmental support for increased investments in scientific research. This narrative is essential for framing the conversation around the importance of federal funding in fostering a thriving startup ecosystem.

Additionally, successful entrepreneurs can leverage their experiences to connect with policymakers, informing them of the symbiotic relationship between research funding and economic growth. By sharing their journeys, entrepreneurs can highlight the potential for new job creation and advancements in technology that stem from research-driven startups, thus positioning themselves as key stakeholders in the advocacy for sustained research funding.

Frequently Asked Questions

What role does Harvard research funding play in the startup ecosystem?

Harvard research funding is crucial for stimulating the startup ecosystem, as it supports innovative research that leads to commercialization. Faculty conduct cutting-edge research in labs, which is often transformed into startups, especially in fields like technology and biomedical science.

How does federal funding contribute to Harvard’s scientific research and economic growth?

Federal funding enhances Harvard’s scientific research capabilities, allowing labs to generate novel ideas that can evolve into successful startups. This funding fosters economic growth by attracting top talent and creating a cycle of innovation that drives industry advancements.

What are the potential effects of cuts to Harvard research funding on entrepreneurship?

Cuts to Harvard research funding may lead to a decrease in the number of startups emerging from the university. The disruption of financial support can hinder the commercialization of innovative projects, ultimately impacting entrepreneurial growth and U.S. economic vitality.

Why is venture capital important for the commercialization of Harvard’s research?

Venture capital is vital for the commercialization of Harvard’s research because it provides the necessary funding to transform lab innovations into viable businesses. Strong research funding attracts venture capitalists eager to invest in promising startups that can emerge from Harvard’s environment.

What is the link between Harvard research funding and the broader tech and biomedical startup landscape?

Harvard research funding provides the infrastructure and resources necessary for tech and biomedical advancement. This funding leads to breakthroughs that are essential for the development of startups in these sectors, strengthening the overall startup landscape and enhancing economic growth.

How might disruptions to Harvard’s research funding impact the future of U.S. innovation?

Disruptions to Harvard’s research funding could stifle U.S. innovation by slowing down the pipeline of transformative ideas emerging from the university’s labs. As startups are key drivers of economic growth and technological progress, funding cuts could result in fewer innovations reaching the market.

What does the future hold for Harvard’s Entrepreneurial Management program in light of funding changes?

In light of funding changes, the future of Harvard’s Entrepreneurial Management program may face challenges in nurturing student-led startups. If research funding continues to wane, students may have fewer opportunities to develop concepts that translate into successful ventures, affecting the entire entrepreneurial ecosystem.

Can federal funding cuts at Harvard affect global competition in entrepreneurship?

Yes, federal funding cuts at Harvard can diminish the university’s ability to attract and retain top global talent in entrepreneurship. This could lead to a decline in the quality of startups and innovations originating in the U.S., ultimately impacting the nation’s competitiveness on a global scale.

| Key Points | Details |

|---|---|

| Funding Freeze | Harvard faced a funding freeze over $2 billion in research grants due to political disputes, affecting science, medicine, and technology. |

| Economic Impact | Projected GDP shrinkage of 3.8% similar to the Great Recession due to cuts in research funding. |

| Role of Research Universities | Research universities like Harvard are critical in fostering startups through both faculty-driven research and student entrepreneurial programs. |

| Incubation Role | The ecosystem at Harvard incubates opportunities for startups, relying on substantial federal funding to thrive. |

| Long-Term Effects | Medium- to long-term impacts will emerge from the funding freeze, affecting the number of startups that can be launched. |

Summary

Harvard research funding plays a pivotal role in ensuring the continuity of innovation and entrepreneurship in the U.S. The disruption of funding mechanisms poses severe risks not only to the immediate capacity for novel research but also to the long-term viability of startup ecosystems that rely on university-led innovation. As evidenced by ongoing challenges and economic projections, this freeze in research funding threatens to undermine the foundational pillars of future growth and technological advancement. Preserving Harvard’s commitment to funding is essential for fostering the next generation of entrepreneurs who will drive economic prosperity and address critical challenges facing society.